Question: Consider a three-factor APT model with self-financing factors. The table below provides the following information for each of the factors: the expected return, the volatility,

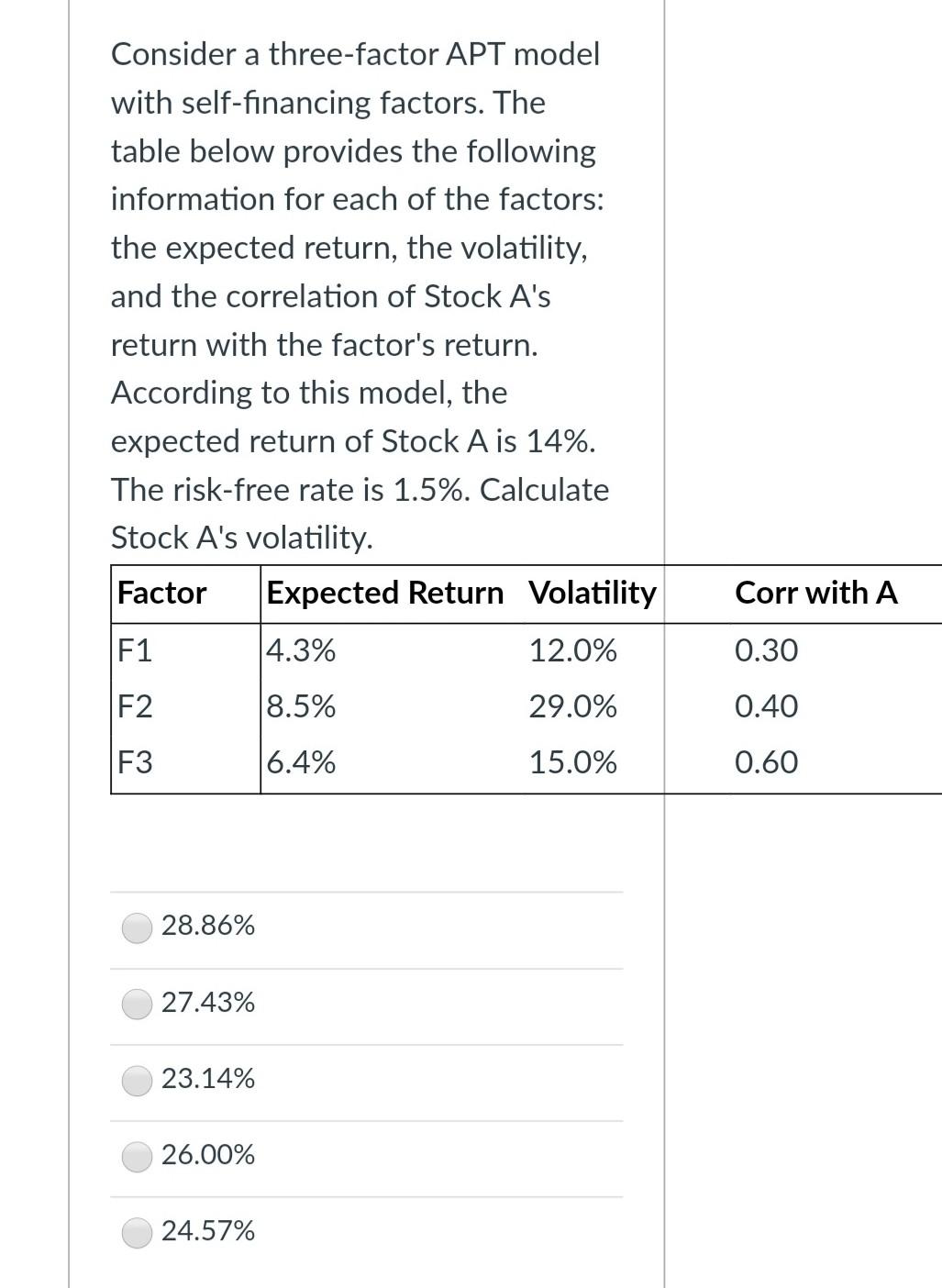

Consider a three-factor APT model with self-financing factors. The table below provides the following information for each of the factors: the expected return, the volatility, and the correlation of Stock A's return with the factor's return. According to this model, the expected return of Stock A is 14%. The risk-free rate is 1.5%. Calculate Stock A's volatility. Factor Expected Return Volatility Corr with A F1 4.3% 12.0% 0.30 F2 8.5% 29.0% 0.40 F3 6.4% 15.0% 0.60 28.86% 27.43% 23.14% 26.00% 24.57%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts