Question: Consider a two period (t = 0, 1, 2) binomial model with u = 1.2, d = .9, continuously compounded interest rate r = 4.879%,

Consider a two period (t = 0, 1, 2) binomial model with u = 1.2, d = .9, continuously compounded interest rate r = 4.879%, and S = 100. The stock will pay no dividends.

What are the values of European call and put options with strike prices of $115 expiring at time 1?

What are the values of European call and put options with strike prices of $115 expiring at time 2?

What are the prices of otherwise identical American options? Does Put-Call Parity hold?

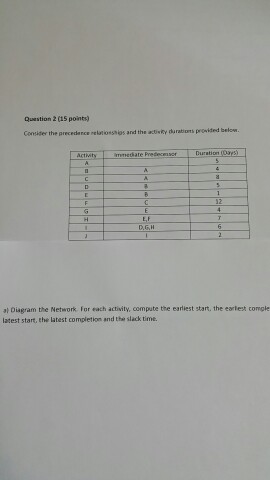

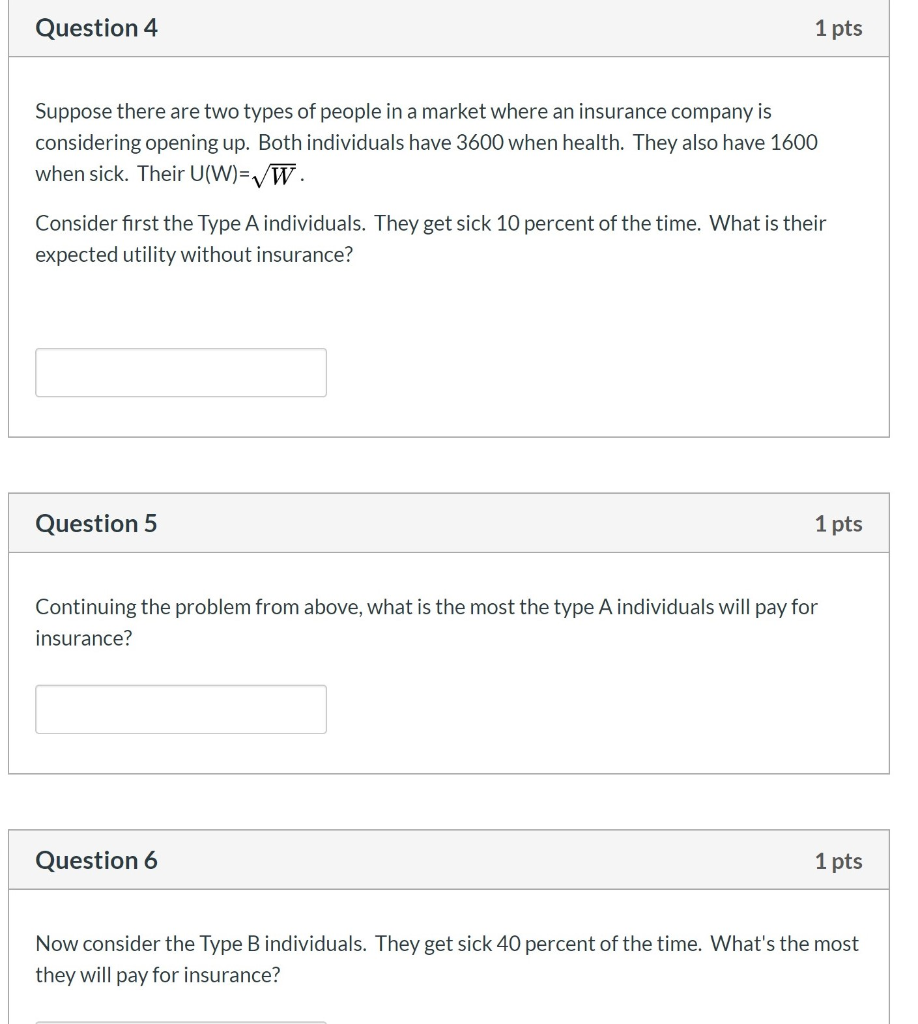

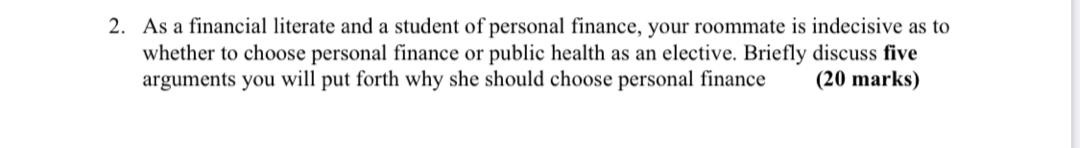

Question 1 (15 points) Contide the precedarce celal loss los and the activity durations provided bolen. Durtion (035) C 1 EF al Diagram the Network for each activity, compute the earliest start. the earliest comple latest start, the latest completion and the slack time.Question 4 1 pts Suppose there are two types of people in a market where an insurance company is considering opening up. Both individuals have 3600 when health. They also have 1600 when sick. Their U(W)=1/W. Consider rst the Type A individuals. They get sick 10 percent of the time. What is their expected utility without insurance? Question 5 1 pts Continuing the problem from above, what is the most the type A individuals will pay for insurance? l _ Question 6 1 pts Now consider the Type B individuals. They get sick 40 percent of the time. What's the most they will pay for insurance? 2. As a financial literate and a student of personal finance, your roommate is indecisive as to whether to choose personal finance or public health as an elective. Briefly discuss five arguments you will put forth why she should choose personal finance (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts