Question: Just question B please 1. == = = Consider a two period (t = 0, 1, 2) binomial model with u = 1.2, d= .9,

Just question B please

Just question B please

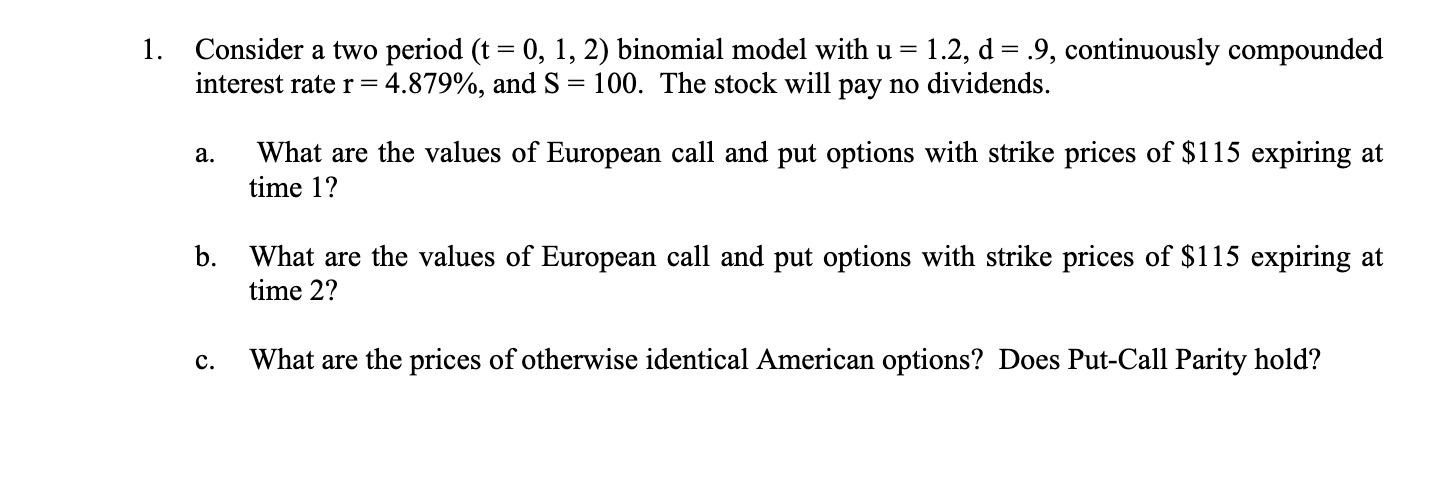

1. == = = Consider a two period (t = 0, 1, 2) binomial model with u = 1.2, d= .9, continuously compounded interest rate r = 4.879%, and S = 100. The stock will pay no dividends. a. What are the values of European call and put options with strike prices of $115 expiring at time 1? b. What are the values of European call and put options with strike prices of $115 expiring at time 2? c. What are the prices of otherwise identical American options? Does Put-Call Parity hold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts