Question: A question about binomial model Question 2 (15 Points) To model the evolution of a stock over the next two years, we consider a two-period

A question about binomial model

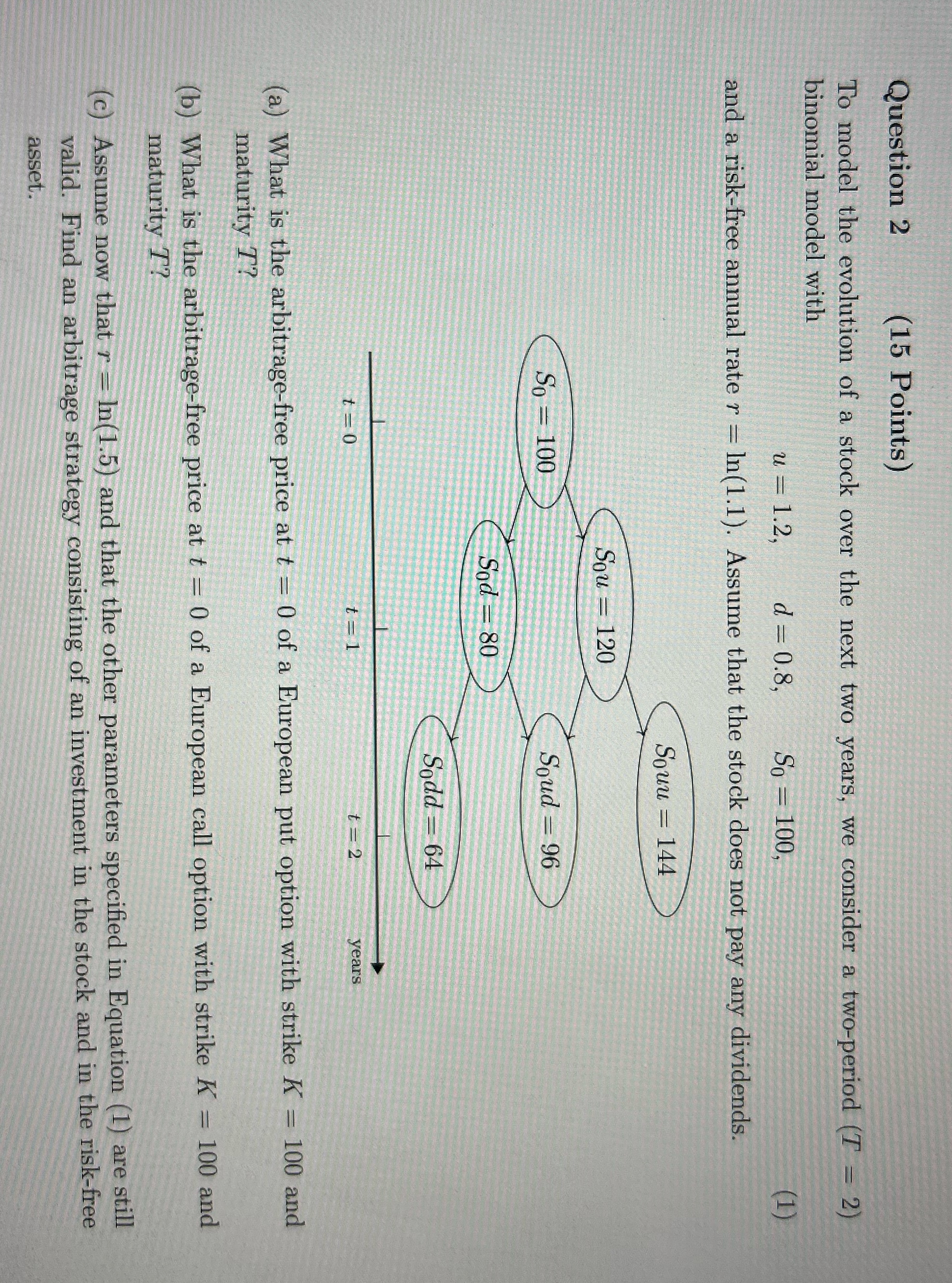

Question 2 (15 Points) To model the evolution of a stock over the next two years, we consider a two-period (T = 2) binomial model with u = 1.2, d = 0.8, So = 100, and a risk-free annual rate r = In(1.1). Assume that the stock does not pay any dividends. Souu = 144 Sou = 120 So = 100 Soud = 96 Sod = 80 Sodd = 64 t =0 t = 2 years (a) What is the arbitrage-free price at t = 0 of a European put option with strike K = 100 and maturity ? (b) What is the arbitrage-free price at t = 0 of a European call option with strike K = 100 and maturity T? (c) Assume now that r = In(1.5) and that the other parameters specified in Equation (1) are still valid. Find an arbitrage strategy consisting of an investment in the stock and in the risk-free asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts