Question: Consider John. He is trying to decide whether or not to enter a full - time MBA program. Currently, he works for IBM as a

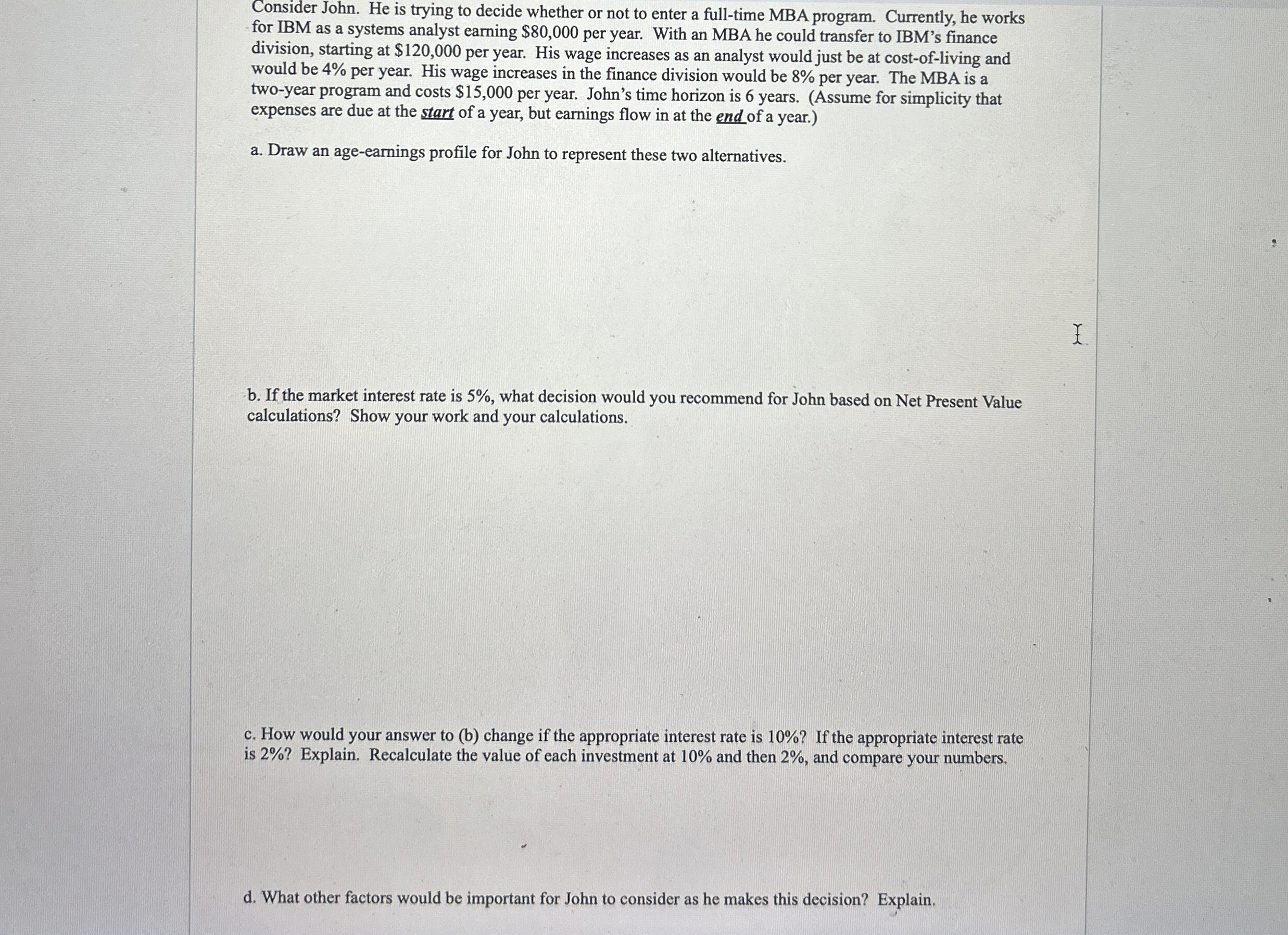

Consider John. He is trying to decide whether or not to enter a fulltime MBA program. Currently, he works for IBM as a systems analyst earning $ per year. With an MBA he could transfer to IBM's finance division, starting at $ per year. His wage increases as an analyst would just be at costofliving and would be per year. His wage increases in the finance division would be per year. The MBA is a twoyear program and costs $ per year. John's time horizon is years. Assume for simplicity that expenses are due at the start of a year, but earnings flow in at the end of a year.

a Draw an ageearnings profile for John to represent these two alternatives.

b If the market interest rate is what decision would you recommend for John based on Net Present Value calculations? Show your work and your calculations.

c How would your answer to b change if the appropriate interest rate is If the appropriate interest rate is Explain. Recalculate the value of each investment at and then and compare your numbers.

d What other factors would be important for John to consider as he makes this decision? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock