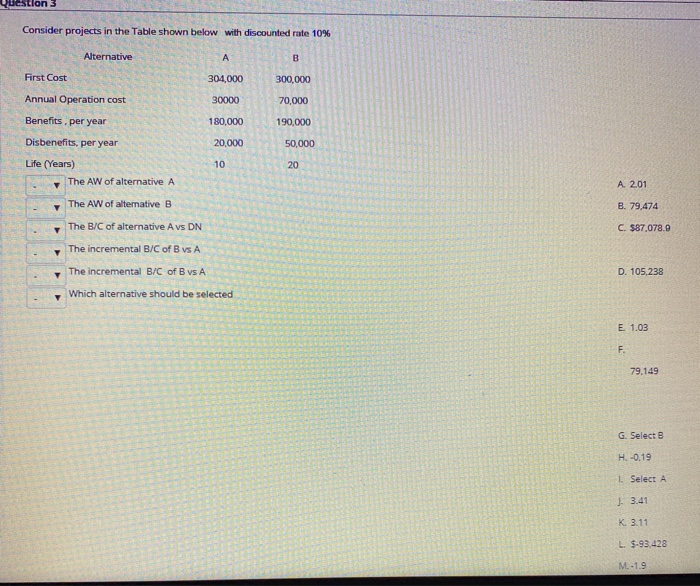

Question: Consider projects in the Table shown below with discounted rate 10% Alternative B First Cost 304,000 300,000 Annual Operation cost 30000 70,000 Benefits. per year

Consider projects in the Table shown below with discounted rate 10% Alternative B First Cost 304,000 300,000 Annual Operation cost 30000 70,000 Benefits. per year 180,000 190.000 Disbenefits, per year 20,000 50,000 10 20 Life (Years) The AW of alternative A A 2.01 B. 79,474 The AW of alternative B The B/C of alternative A vs DN The incremental B/C of B vs A C. $87.078.0 The incremental B/C of B vs A D. 105,238 Which alternative should be selected E 1.03 F. 79.149 G. Select B H.-0.19 1. Select A 3.41 K 3.11 L. 5-93,428 M.-1.9 Consider projects in the Table shown below with discounted rate 10% Alternative B First Cost 304,000 300,000 Annual Operation cost 30000 70,000 Benefits. per year 180,000 190.000 Disbenefits, per year 20,000 50,000 10 20 Life (Years) The AW of alternative A A 2.01 B. 79,474 The AW of alternative B The B/C of alternative A vs DN The incremental B/C of B vs A C. $87.078.0 The incremental B/C of B vs A D. 105,238 Which alternative should be selected E 1.03 F. 79.149 G. Select B H.-0.19 1. Select A 3.41 K 3.11 L. 5-93,428 M.-1.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts