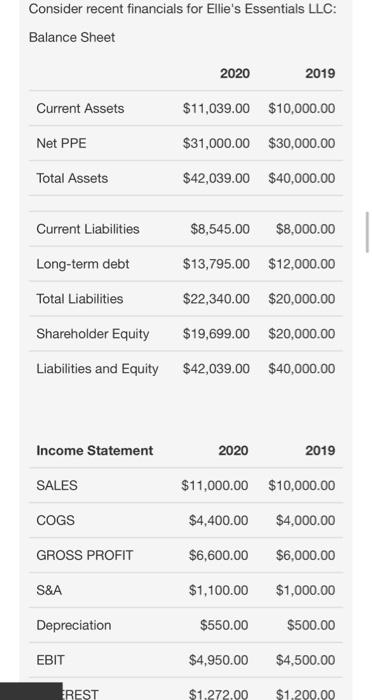

Question: Consider recent financials for Ellie's Essentials LLC: Balance Sheet Going forward, analysts have forecasted the following free cash flows: $2,550.00 in 2021, and $2,600.00 in

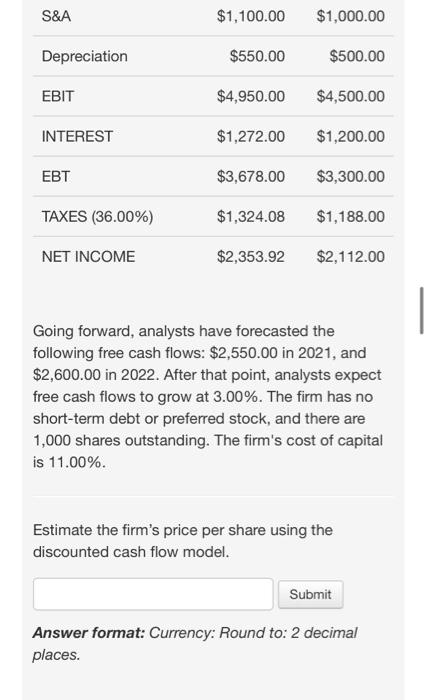

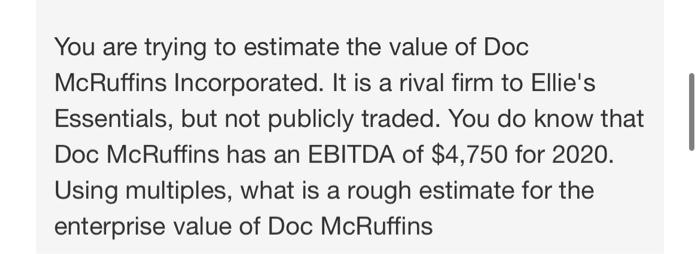

Consider recent financials for Ellie's Essentials LLC: Balance Sheet Going forward, analysts have forecasted the following free cash flows: $2,550.00 in 2021, and $2,600.00 in 2022. After that point, analysts expect free cash flows to grow at 3.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 11.00%. Estimate the firm's price per share using the discounted cash flow model. Answer format: Currency: Round to: 2 decimal places. You are trying to estimate the value of Doc McRuffins Incorporated. It is a rival firm to Ellie's Essentials, but not publicly traded. You do know that Doc McRuffins has an EBITDA of $4,750 for 2020. Using multiples, what is a rough estimate for the enterprise value of Doc McRuffins

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts