Question: Consider the binomial model where a non-dividend-paying stock S has current price So = 40 and in 1 year time it can either be

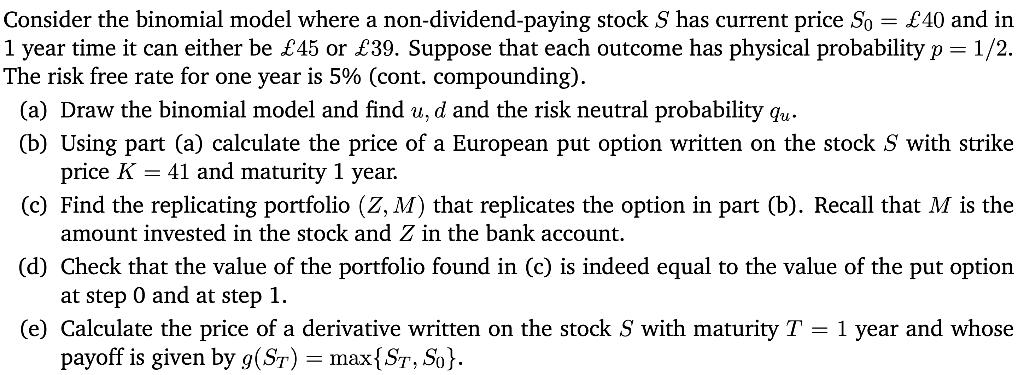

Consider the binomial model where a non-dividend-paying stock S has current price So = 40 and in 1 year time it can either be 45 or 39. Suppose that each outcome has physical probability p = 1/2. The risk free rate for one year is 5% (cont. compounding). (a) Draw the binomial model and find u, d and the risk neutral probability qu. (b) Using part (a) calculate the price of a European put option written on the stock S with strike price K 41 and maturity 1 year. (c) Find the replicating portfolio (Z, M) that replicates the option in part (b). Recall that M is the amount invested in the stock and Z in the bank account. (d) Check that the value of the portfolio found in (c) is indeed equal to the value of the put option at step 0 and at step 1. (e) Calculate the price of a derivative written on the stock S with maturity T = payoff is given by 9(ST) = max{ST, So}. 1 year and whose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts