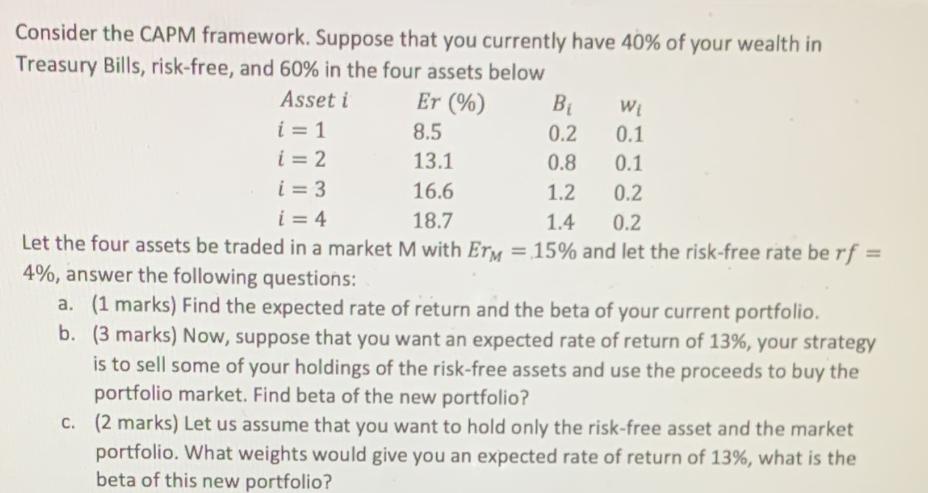

Question: Consider the CAPM framework. Suppose that you currently have 40% of your wealth in Treasury Bills, risk-free, and 60% in the four assets below

Consider the CAPM framework. Suppose that you currently have 40% of your wealth in Treasury Bills, risk-free, and 60% in the four assets below Asset i Bi W i = 1 0.2 0.1 i = 2 0.8 0.1 i=3 1.2 0.2 i = 4 18.7 1.4 0.2 Let the four assets be traded in a market M with ETM = 15% and let the risk-free rate be rf 4%, answer the following questions: a. (1 marks) Find the expected rate of return and the beta of your current portfolio. b. (3 marks) Now, suppose that you want an expected rate of return of 13%, your strategy is to sell some of your holdings of the risk-free assets and use the proceeds to buy the portfolio market. Find beta of the new portfolio? c. (2 marks) Let us assume that you want to hold only the risk-free asset and the market portfolio. What weights would give you an expected rate of return of 13%, what is the beta of this new portfolio? Er (%) 8.5 13.1 16.6

Step by Step Solution

There are 3 Steps involved in it

a To find the expected rate of return and the beta of the current portfolio we can use the following ... View full answer

Get step-by-step solutions from verified subject matter experts