Question: Consider the following. a . Calculate the leverage - adjusted duration gap of an F I that has assets of $ 1 . 8 million

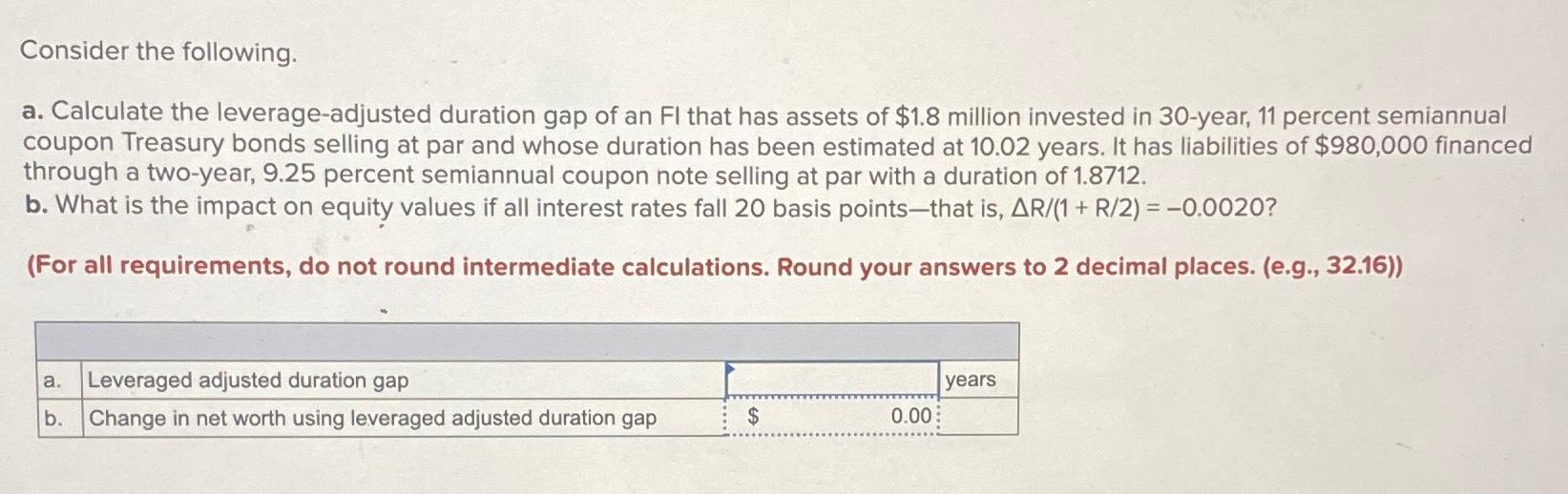

Consider the following.

a Calculate the leverageadjusted duration gap of an that has assets of $ million invested in year, percent semiannual coupon Treasury bonds selling at par and whose duration has been estimated at years. It has liabilities of $ financed through a twoyear, percent semiannual coupon note selling at par with a duration of

b What is the impact on equity values if all interest rates fall basis pointsthat is

For all requirements, do not round intermediate calculations. Round your answers to decimal places. eg

tableaLeveraged adjusted duration gap,yearsbChange in net worth using leveraged adjusted duration gap,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock