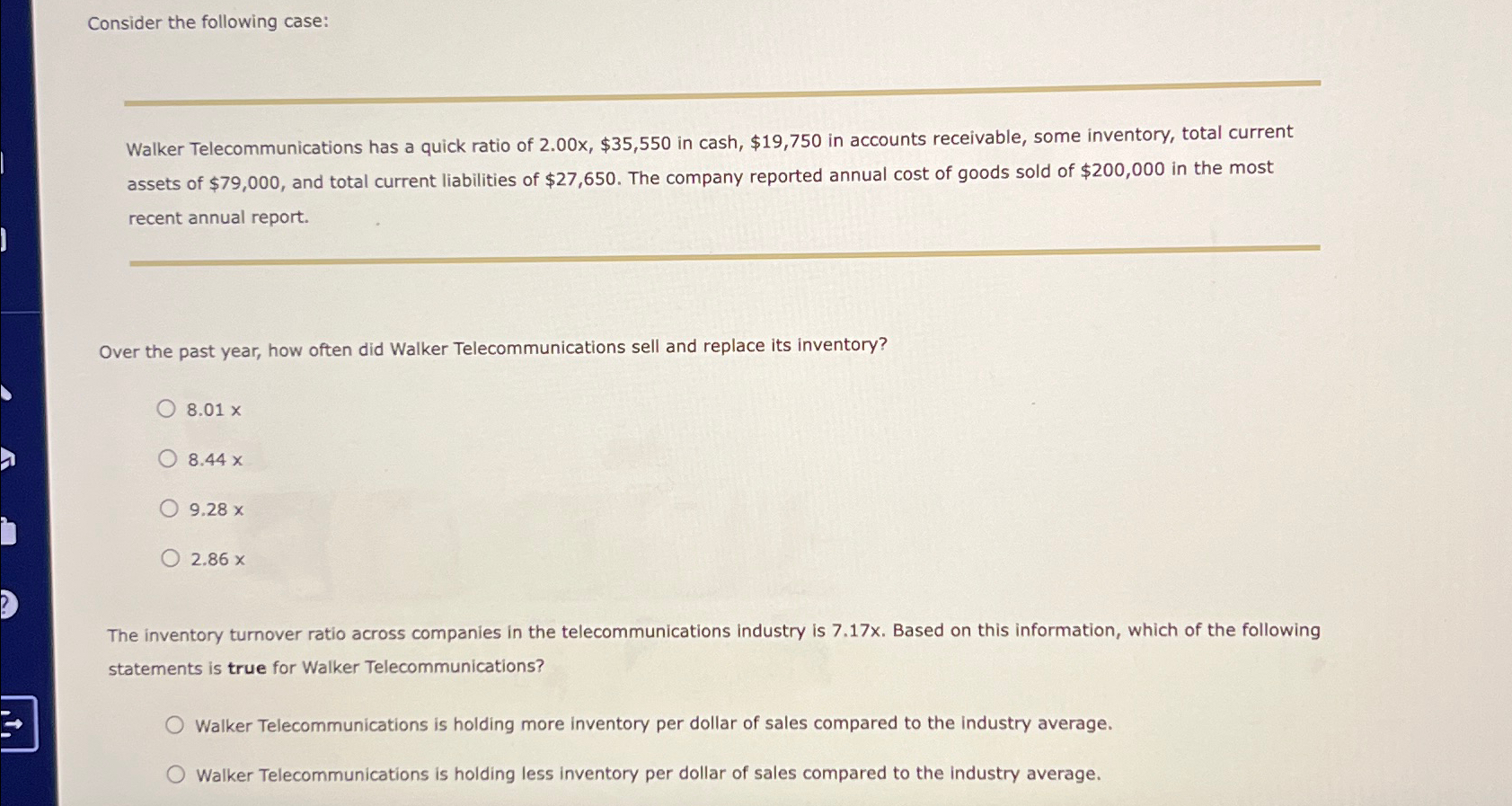

Question: Consider the following case: Walker Telecommunications has a quick ratio of 2 . 0 0 x , $ 3 5 , 5 5 0 in

Consider the following case:

Walker Telecommunications has a quick ratio of $ in cash, $ in accounts receivable, some inventory, total current assets of $ and total current liabilities of $ The company reported annual cost of goods sold of $ in the most recent annual report.

Over the past year, how often did Walker Telecommunications sell and replace its inventory?

The inventory turnover ratio across companies in the telecommunications industry is Based on this information, which of the following statements is true for Walker Telecommunications?

Walker Telecommunications is holding more inventory per dollar of sales compared to the industry average.

Walker Telecommunications is holding less inventory per dollar of sales compared to the industry average.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock