Question: Consider the following expected return, variance and correlation values for the three securities listed below: (a) What is the portfolio expected return for each of

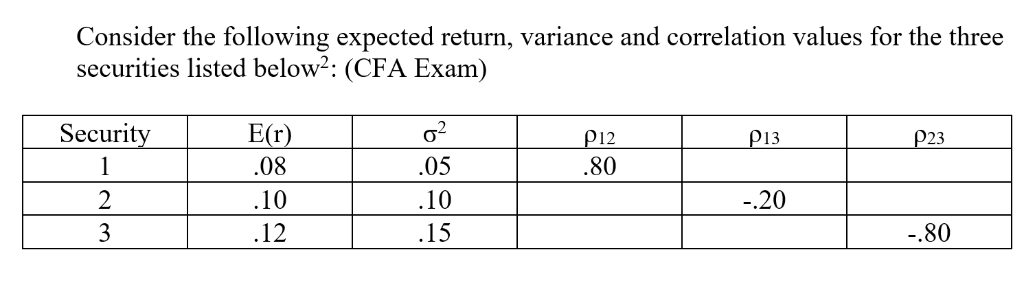

Consider the following expected return, variance and correlation values for the three securities listed below:

(a) What is the portfolio expected return for each of the following combinations: (Note: Each portfolio has two stocks, not three!)

(b) What are the variances and standard deviations for each portfolio as in Part a?

(c) Which of the two portfolios would you choose? Why?

Consider the following expected return, variance and correlation values for the three securities listed below2: (CFA Exam) SecurityE P12 .80 p13 D23 .08 .10 12 .05 .10 15 2 20 -.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts