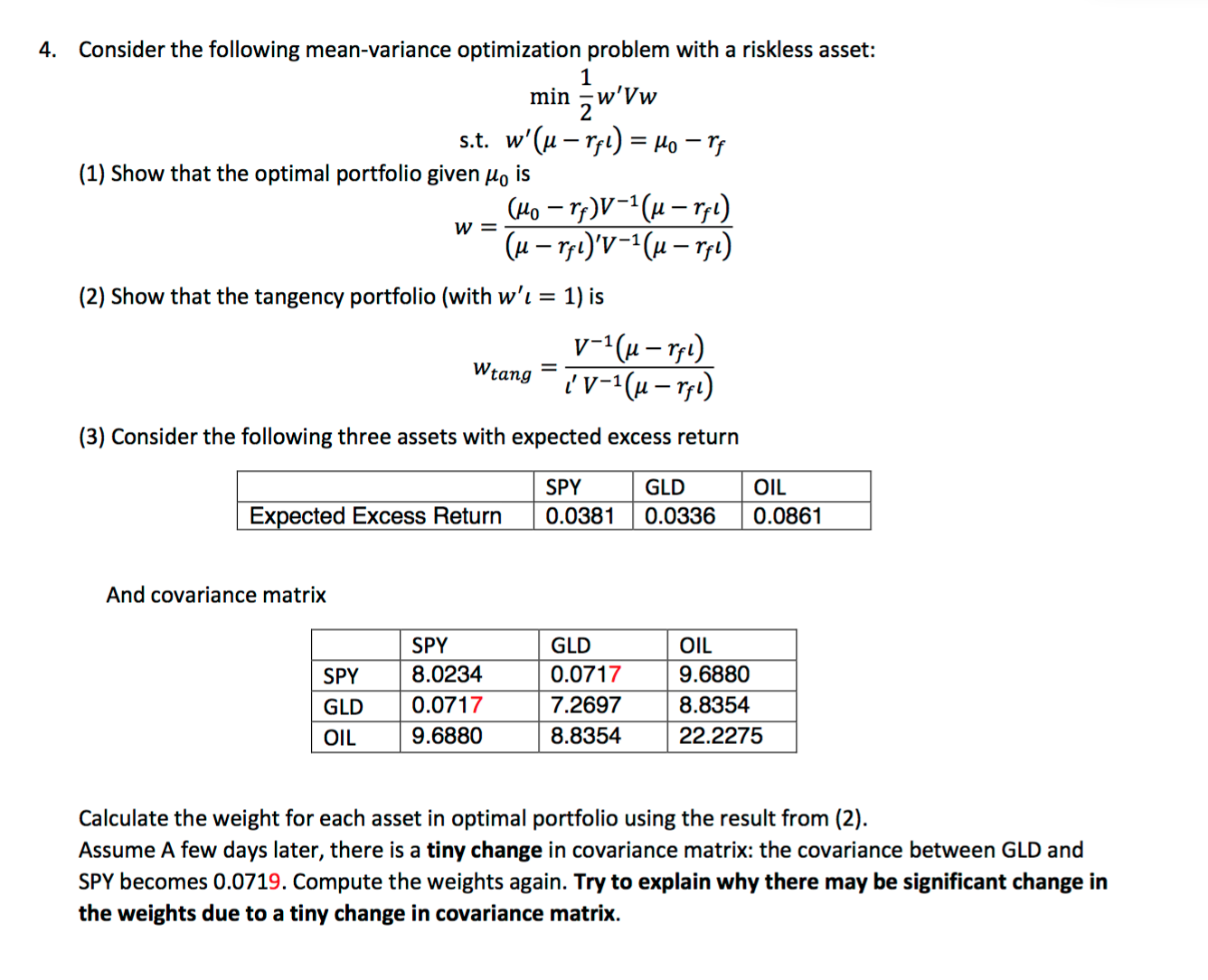

Question: Consider the following mean-variance optimization problem with a riskless asset: min 1/2 w'Vw s.t. w'(mu - r_fl) = mu_0 - r_f Show that the optimal

Consider the following mean-variance optimization problem with a riskless asset: min 1/2 w'Vw s.t. w'(mu - r_fl) = mu_0 - r_f Show that the optimal portfolio given w = (mu_0 - r_f)V^- 1 (mu - r_f l)/mu - r_f l)'V^- 1(mu - r_f l) Show that the tangency portfolio (with w'l = 1) is w_tang = V^- 1(mu r_fl)/l' V^- 1 (mu - r_f l) Consider the following three assets with expected excess return And covariance matrix Calculate the weight for each asset in optimal portfolio using the result from (2). Assume A few days later, there is a tiny change in covariance matrix: the covariance between GLD and SPY becomes 0.0719. Compute the weights again. Try to explain why there may be significant change in the weights due to a tiny change in covariance matrix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts