Question: here is the file Investment Portfolio Optimization Using Mean-Variance Analysis Question 1. Let's first consider investment portfolios that include only two risky assets: VINIX (a

here is the file

here is the file

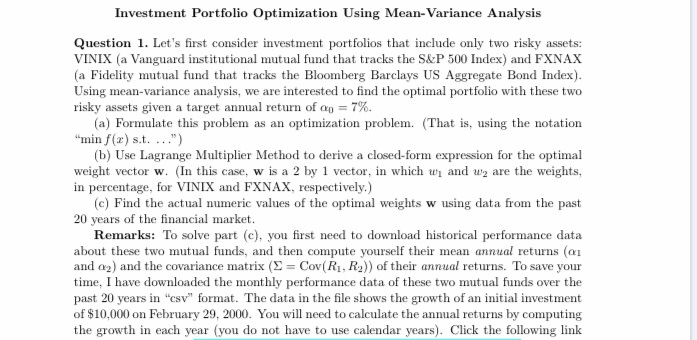

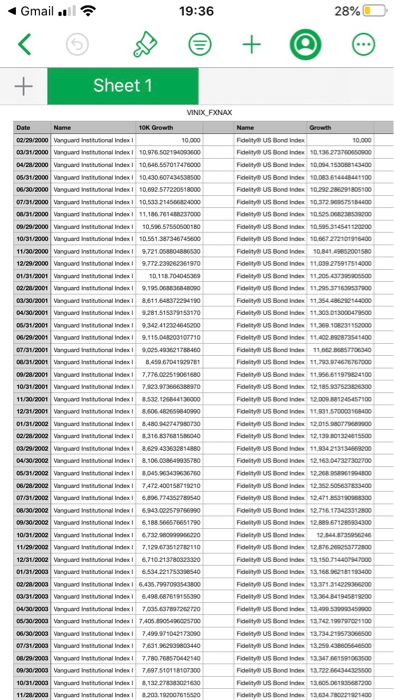

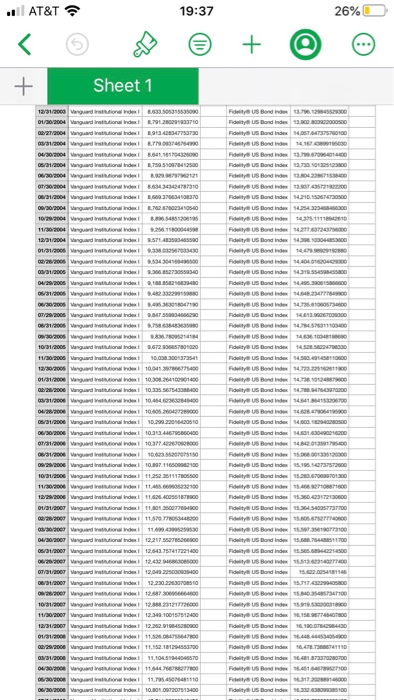

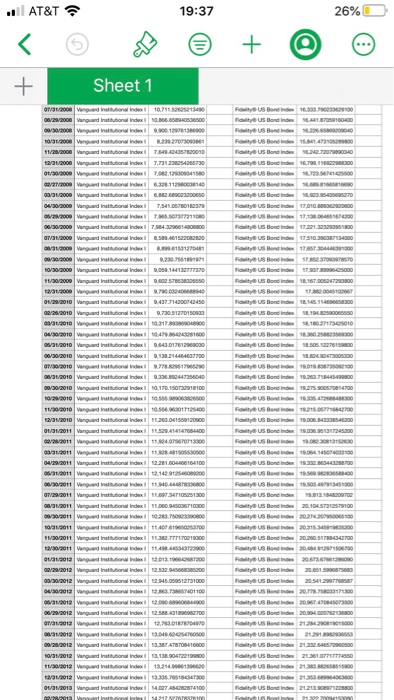

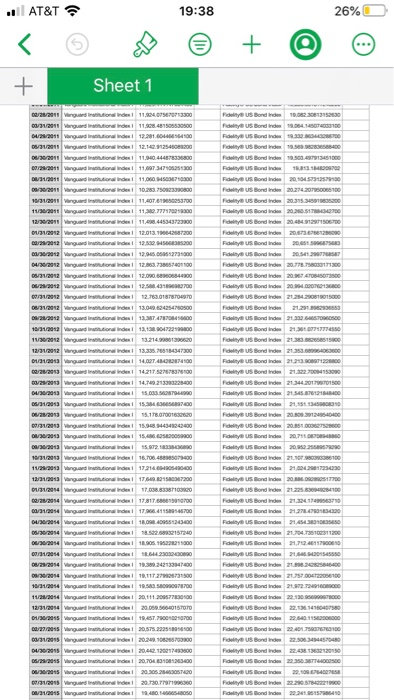

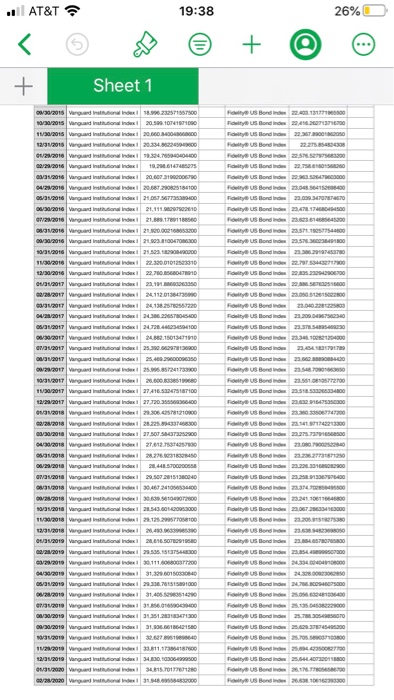

Investment Portfolio Optimization Using Mean-Variance Analysis Question 1. Let's first consider investment portfolios that include only two risky assets: VINIX (a Vanguard institutional mutual fund that tracks the S&P 500 Index) and FXNAX (a Fidelity mutual fund that tracks the Bloomberg Barclays US Aggregate Bond Index). Using mean-variance analysis, we are interested to find the optimal portfolio with these two risky assets given a target annual return of a = 7%. (a) formulate this problem as an optimization problem. (That is, using the notation "min f(x) .....") (b) Use Lagrange Multiplier Method to derive a closed-form expression for the optimal weight vector w. (In this case, w is a 2 by 1 vector, in which w and we are the weights, in percentage, for VINIX and FXNAX, respectively.) (c) Find the actual numeric values of the optimal weights w using data from the past 20 years of the financial market. Remarks: To solve part (c), you first need to download historical performance data about these two mutual funds, and then compute yourself their mean annual returns (a1 and 2) and the covariance matrix (S = Cov(R1, R2)) of their annual returns. To save your time. I have downloaded the monthly performance data of these two mutual funds over the past 20 years in "csv" format. The data in the file shows the growth of an initial investment of $10,000 on February 29, 2000. You will need to calculate the annual returns by computing the growth in each year (you do not have to use calendar years). Click the following link Gmail. 19:36 28% + Sheet 1 VINOX FOLX 2000 guard ona del 1/2000 SPOD 2000 guard index 10.54556701478000 2000 Vanguard nun index 10.430 434538500 06/30/2000 Vanguard index 10.602 577220513000 2000 Vargard online 0.03. 2 0 00 //2000 et 10657550500180 10/32000 Vod onidest 10.55138734645600 11/30/2000 Vanguard institutional Index 9.721058 5 30 12/28/2000 Vanguardin a lindex 9.772239262361970 01/31/2001 Vanguard o na Index 10.116.704045569 /21/2001 Vanguard tutional Index 9.195. 0 0 0 03/30/2001 Va n dex 8.611 648372294190 04/30/2001 Vanguard institutional Index 9.281.515879153170 05/31/2001 Vargu institutional Index 9.342.412324545200 06/29/2001 Vanguardistonindex 8.115.04.203107710 OT/31/2001 Vanguard national Index 9.00.40321785460 01/31/2001 Vanguard institutional Index 1.450.67041929781 /20/2001 Vargurdino index 7.776.002515061680 10/31/2001 Vrouwd i n dex 7823.973666388970 11/30/2001 Vanguard institutional Index 8.532.12044136000 12/312001 Vanguard institutional Index 8.606.48265940990 01/31/2002 Vanguard index 8.480.42747980730 0/21/2000 Vagardintutional Index 3.316.7601586040 03/20/2000 Vard nindex 8.629.433632814880 04/30/2000 d onde 8105.038649835780 06/312000 Vanguard o na index 3.045. 6700 1/2000 index 7472.400158713210 01/01/2000 STOSO 2002 d o 902257979 2000 188.68575651790 101/2000 gr ade 72200220 11/20/2000 garduod 7.129.6735170110 12/31/2000 V ard onnel 71021378082330 01/01/2000 534225 SAD GQ/ 2000 Vanguard online 6.435.799TONOSCO 2000 Vard index 5.498687619155090 04/2000 unit 7 720 06/2009 ago st 2007 06/30/2000 V o 7402173000 OTV1000 V o l 763140 01/29/2000 Var d et 778076852140 00/70/2000 Vard e 749751011107300 10/31/2000 V a lidt 8182278383021630 11/21/2000 gardrotutional Index 3.205.180007615870 FoUSBond Index o USB F US Bond 001400 F US Bond FUS Bond 0 0 FUSO For Us Bond Fidelity Us Bond 011000 Fidelity Us Bond Foot US Band 10.01. 2010 delity Us Bond Index 11.02.275917514000 Fidelity US Bond 11.20 Fidelity US Bondine 1193160 Fidelity US Bond in 1 0 00 Fidelity US Bondex 11.00 Fidelity US Bonde 11102112000 Fidelity Us Bond Index 11.02273541400 Fidelity US Bendides 11 :40 Fidelity Us Bond Index 11.793676767000 Fidelity US Bond Index 11.956.61197904100 Fidelity US Bondine 12.1853720300 Fidelity Us Bond Index 12000 1245457100 Fidelity US Bendinden 11.01570000165400 Fidelity UsBondine 2015 Fidelity Us Bond Index 12.10.2013150 Fidelity US Bondine Fidelity Us Bond Index 12.03. 0 7 Folye Us Bondine 12 Fidelity US Bendid 123525 4 00 Fidelity Us Bond F US Bond 2017 F US Bondine 12 USB 2.0 F US Band FUS Band 100 Fideus Bond 121617400 F US Bond Fidel US Bond Index 13 2 00 Fid USB 3. Fideus Bond 0071100 Fidelity US Bond F US Bonne 32 Fidelity Us Bond Index del US Bondine 172 Fidelity Us Bond in 3 2 00 Fidelity Us Bond in 3 4 00 .. AT&T 19:37 26%D + Sheet 1 US FUSS Bond US USSON Mengan FUSS Us Bond Route Ustand index FUSS US Bodi 14.00 Polity USB Fidelity Us Bond Index 54.500. 0 USB 3.22 F USE Megd uto 0 0 11/30/2005 100 index W 10.050.3005379541 100415400 200 g ration Index 103355675430 dutyus Bond Index 14. USB FUS Mang a l index 10.09.2001 duty Us Bond Index 4.000 FUSO 10.03.2010 US .. AT&T 19:37 26%D + Sheet 1 1/30/2000 2010 Vanguardian 2/26/2010 Vanguard i an Index 9,73031270150933 2010 031 07/2010 Vandex 10: 4 0 1/31/2010 Vanguard i an Index 9.543.017120000 USB 1. 31/2010 How Us Bond USB USB USB U tom 2015 Vanguardian Index AS 1 00 26%D ..AT&T ?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts