Question: Consider the following nancial planning problem. Suppose that you start the year with $3,800 in cash, and your expected liabilities throughout the year are as

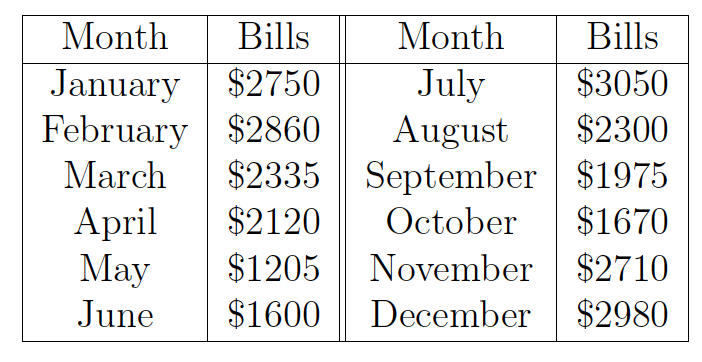

Consider the following nancial planning problem. Suppose that you start the

year with $3,800 in cash, and your expected liabilities throughout the year are as follows:

Suppose also that your salary (after taxes and benets) is $2450 per month. For sim-

plicity, assume that you are always paid on the 1st of each month, and that bills are due

sometime before the end of the month.

You have decided that you will invest any money that you don't use to meet your liabilities

each month in either 1-month, 3-month, or 7-month short-term investment vehicles. The

yield on 1-month investments is 6% per year nominal (thus, you get $0.005 for each dollar

invested after one month); for 3- and 7-month investments, the yields are 8% and 12% per

year nominal. Your investment strategy has the following characteristics:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts