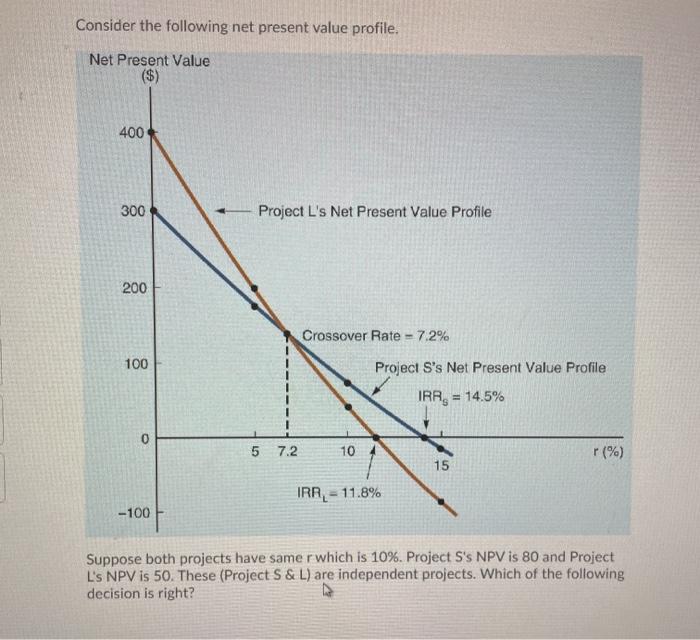

Question: Consider the following net present value profile. Net Present Value 400 300 Project L's Net Present Value Profile 200 Crossover Rate -7.2% 100 Project S's

Consider the following net present value profile. Net Present Value 400 300 Project L's Net Present Value Profile 200 Crossover Rate -7.2% 100 Project S's Net Present Value Profile IRR = 14.5% 5 7.2 10 r (%) 15 IRR - = 11.8% -100 Suppose both projects have same r which is 10%. Project S's NPV is 80 and Project L's NPV is 50. These (Project S & L) are independent projects. Which of the following decision is right? Suppose both projects have same r which is 10%. Project S's NPV is 80 and Project L's NPV is 50. These (Project S&L) are independent projects. Which of the following decision is right? Accept Projects, but reject Project L. Accept both projects. Accept Project L, but reject Project S. Reject both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts