Question: Consider the following structural VAR models Argust Arjust Aygust Ayjust = (L) Argust-1 Arjust-1 Aygust-1 Ayjust-1 + Aet, where rgust is the log of

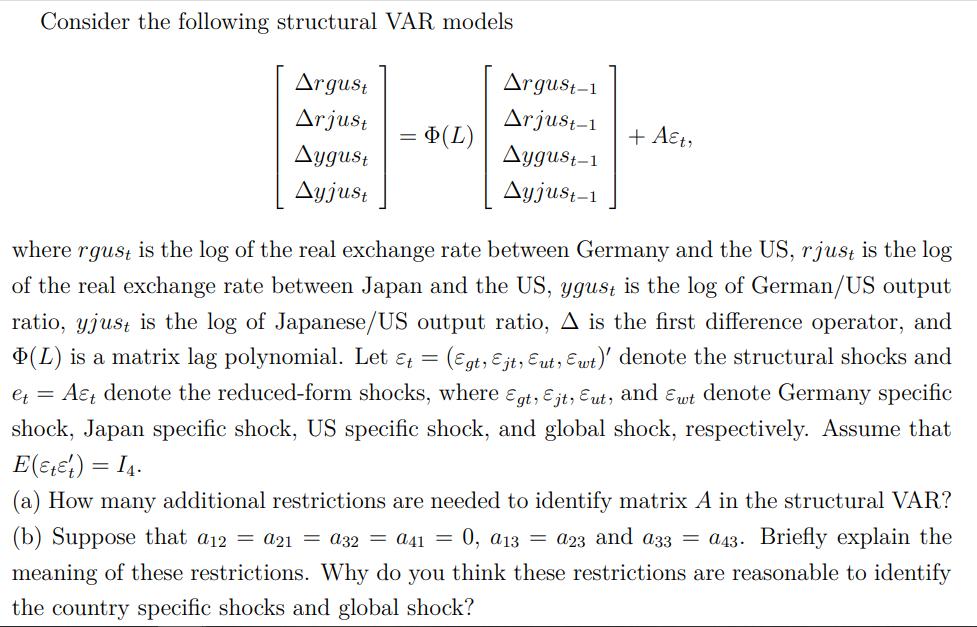

Consider the following structural VAR models Argust Arjust Aygust Ayjust = (L) Argust-1 Arjust-1 Aygust-1 Ayjust-1 + Aet, where rgust is the log of the real exchange rate between Germany and the US, rjust is the log of the real exchange rate between Japan and the US, ygust is the log of German/US output ratio, yjust is the log of Japanese/US output ratio, A is the first difference operator, and (L) is a matrix lag polynomial. Let &t = (Egt, Ejt, Eut, Ewt)' denote the structural shocks and et = At denote the reduced-form shocks, where Egt, Ejt, Eut, and Ewt denote Germany specific shock, Japan specific shock, US specific shock, and global shock, respectively. Assume that E(Etet) = 1. (a) How many additional restrictions are needed to identify matrix A in the structural VAR? (b) Suppose that a12 = a21 = a32 = a41 = 0, a13 = a23 and a33 = a43. Briefly explain the meaning of these restrictions. Why do you think these restrictions are reasonable to identify the country specific shocks and global shock?

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

The image contains a question related to the identification of a matrix A within the context of a structural Vector Autoregression VAR model The quest... View full answer

Get step-by-step solutions from verified subject matter experts