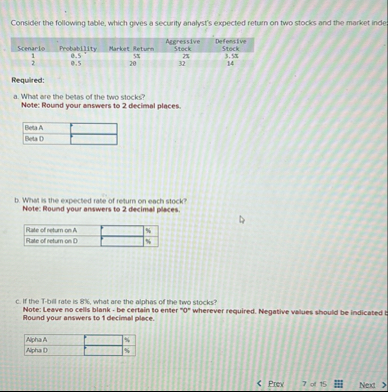

Question: Consider the following table, which gives a security analyst's expected return on two stocks and the market inde table [ [ , Probablility,Narket Return,Ageressive,Stock

Consider the following table, which gives a security analyst's expected return on two stocks and the market inde

tableProbablility,Narket Return,Ageressive,StockScenarloStock,,,

Required:

a What are the betas of the two stocks?

Note: Round your answers to decimal places.

tableBetaABeta D

b What is the expected rate of return on each stock?

Note: Round your answers to decimal places.

tableRate of retum ion ARate of setum ion D

c If the Tbill rate is what are the alphas of the two stocks?

Note: Leave no cells blank be certain to enter wherever required. Negative values should be indicabed b Round your answers to decimel ploce.

tableAphaARpha D

Prex

of

Nex

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock