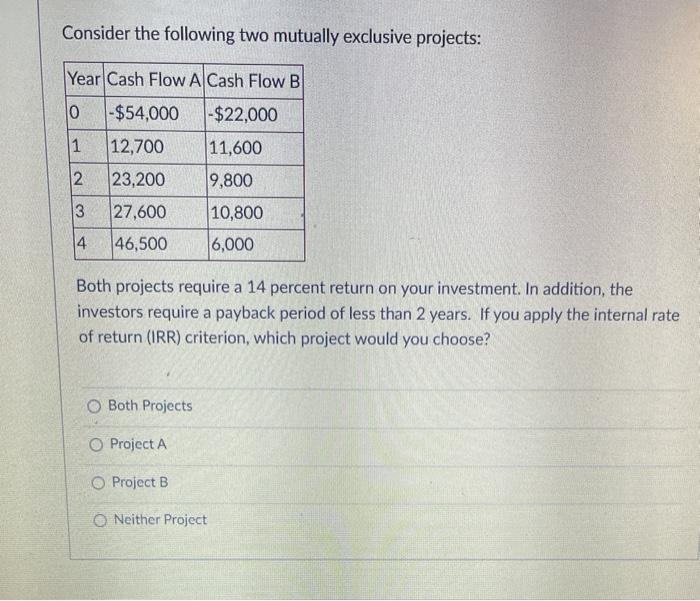

Question: Consider the following two mutually exclusive projects: Year Cash Flow A Cash Flow B 0 -$54,000 -$22,000 1 12,700 11,600 2 23,200 9,800 3 27,600

Consider the following two mutually exclusive projects: Year Cash Flow A Cash Flow B 0 -$54,000 -$22,000 1 12,700 11,600 2 23,200 9,800 3 27,600 10,800 6,000 4 46,500 Both projects require a 14 percent return on your investment. In addition, the investors require a payback period of less than 2 years. If you apply the internal rate of return (IRR) criterion, which project would you choose? O Both Projects Project A O Project B Neither Project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts