Question: . Problem #7 (Expected NPV): Waste Management, Inc. is analyzing a new waste bin which biodegrades waste, without odor, in 5 minutes or less. The

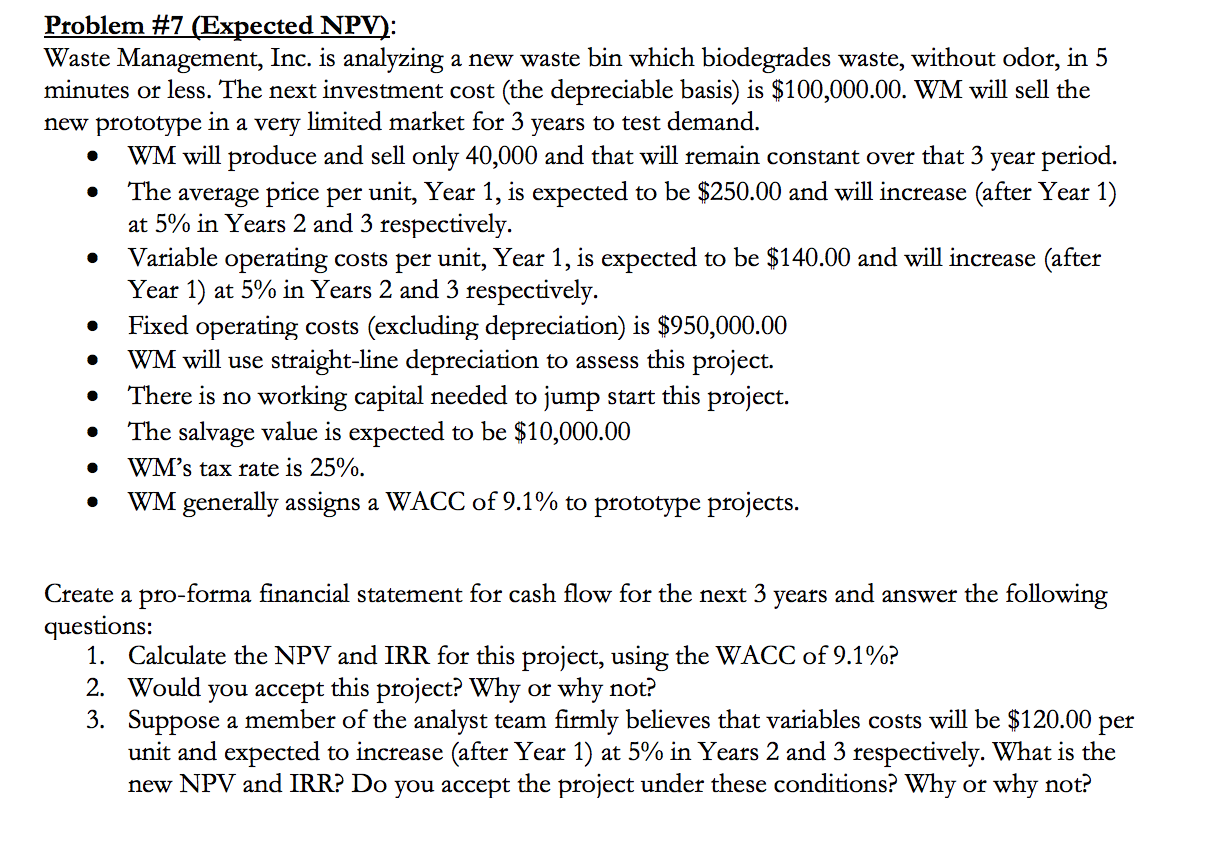

. Problem #7 (Expected NPV): Waste Management, Inc. is analyzing a new waste bin which biodegrades waste, without odor, in 5 minutes or less. The next investment cost (the depreciable basis) is $100,000.00. WM will sell the new prototype in a very limited market for 3 years to test demand. WM will produce and sell only 40,000 and that will remain constant over that 3 year period. The average price per unit, Year 1, is expected to be $250.00 and will increase (after Year 1) at 5% in Years 2 and 3 respectively. Variable operating costs per unit, Year 1, is expected to be $140.00 and will increase (after Year 1) at 5% in Years 2 and 3 respectively. Fixed operating costs (excluding depreciation) is $950,000.00 WM will use straight-line depreciation to assess this project. There is no working capital needed to jump start this project. The salvage value is expected to be $10,000.00 WM's tax rate is 25%. WM generally assigns a WACC of 9.1% to prototype projects. . . . . Create a pro-forma financial statement for cash flow for the next 3 years and answer the following questions: 1. Calculate the NPV and IRR for this project, using the WACC of 9.1%? 2. Would you accept this project? Why or why not? 3. Suppose a member of the analyst team firmly believes that variables costs will be $120.00 per unit and expected to increase (after Year 1) at 5% in Years 2 and 3 respectively. What is the new NPV and IRR? Do you accept the project under these conditions? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts