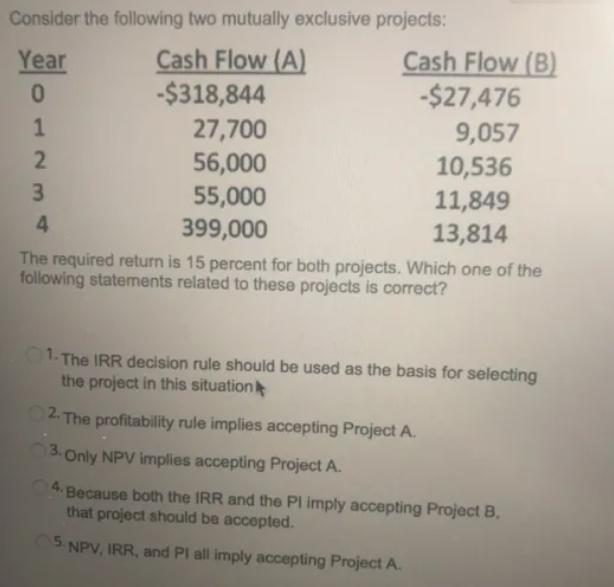

Question: Consider the following two mutually exclusive projects: Year Cash Flow (A) 0 -$318,844 1 27,700 2 56,000 3 4 55,000 399,000 Cash Flow (B)

Consider the following two mutually exclusive projects: Year Cash Flow (A) 0 -$318,844 1 27,700 2 56,000 3 4 55,000 399,000 Cash Flow (B) -$27,476 9,057 10,536 11,849 13,814 The required return is 15 percent for both projects. Which one of the following statements related to these projects is correct? 1. The IRR decision rule should be used as the basis for selecting the project in this situation 02. The profitability rule implies accepting Project A. 3. Only NPV implies accepting Project A. 4. Because both the IRR and the PI imply accepting Project B. that project should be accepted. 05.1 NPV, IRR, and PI all imply accepting Project A.

Step by Step Solution

There are 3 Steps involved in it

To determine the correct statement related to these projects we need to evaluate each project using different capital budgeting decision rules 1 The I... View full answer

Get step-by-step solutions from verified subject matter experts