Question: Consider the following two - period overlapping generations model. The size o f each cohort i s normalised t o 1 and there i s

Consider the following twoperiod overlapping generations model. The size

each cohort normalised and there population growth. Young

agents supply one unit labour inelastically and save, while old agents

retire and consume. Agents maximise expected consumption when old

Final output produced a large number firms according

follows that Moreover, capital depreciated

entirely after one period.

Assume that there are productive and unproductive agents, denoted

and respectively. Both types agents differ with respect their

productivity build physical capital the sense that marginal

product capital just a share marginal product. The population

share agents the one agents

Young agents have the additional option purchasing bubbles

schemes where denotes the stock existing bubbles until and

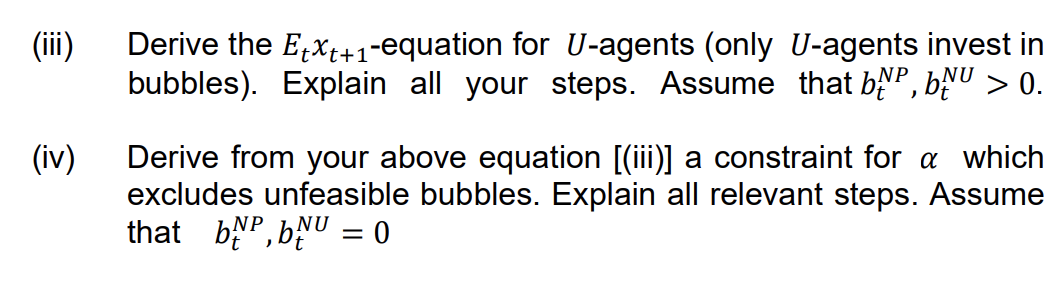

represents the stock new bubbles created Derive the equation for agents invest

Derive from your above equation a constraint for

excludes unfeasible bubbles. Explain all relevant steps. Assume

that

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock