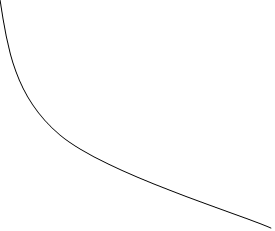

Question: Consider the following two projects. 0 1 2 3 |---------------------|-----------------------|----------------------| Project A: -1,000 500 500 280 Project B: -1,000 430 430 430 NPV Profile NPV

Consider the following two projects.

0 1 2 3

|---------------------|-----------------------|----------------------|

Project A: -1,000 500 500 280

Project B: -1,000 430 430 430

NPV Profile

NPV

NPV

NPV1 Project B

NPV1 Project B

Project A

Project A

NPV2

NPV2

NPV3

r1 r2 r3 Projects cost of capital (= r)

Find r1(crossover rate), r2, and r3.

If the projects cost of capital is 10% and the projects are mutually exclusive (only highest NPV project should be chosen), what project do you have to choose? What if the projects cost of capital is 3%?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts