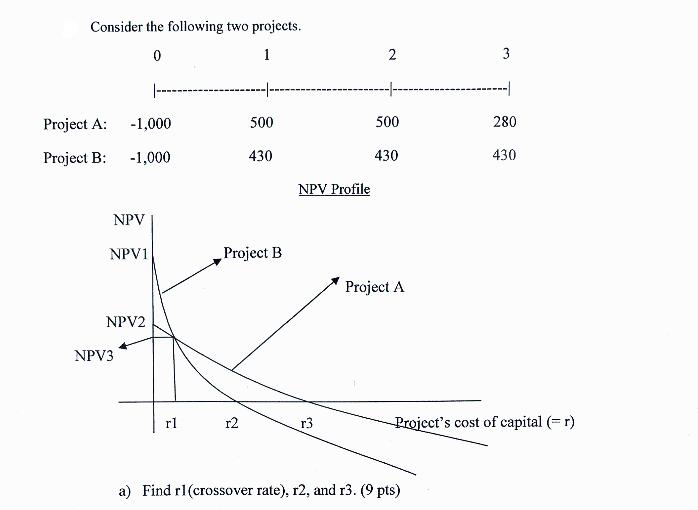

Question: Consider the following two projects. 0 1 Project A: -1,000 Project B: -1,000 NPV NPV1 NPV2 NPV3 rl 500 r2 430 Project B NPV

Consider the following two projects. 0 1 Project A: -1,000 Project B: -1,000 NPV NPV1 NPV2 NPV3 rl 500 r2 430 Project B NPV Profile r3 2 500 430 Project A 3 a) Find r1(crossover rate), r2, and r3. (9 pts) 280 430 Project's cost of capital (= r) If the project's cost of capital is 10% and the projects are mutually exclusive (only highest NPV project should be chosen), what project do you have to choose? What if the project's cost of capital is 3% ? (10 pts)

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

1 2 3 st 4 5 6 7 8 9 10 a 11 12 13 14 b 15 16 2 5 6 7 ... View full answer

Get step-by-step solutions from verified subject matter experts