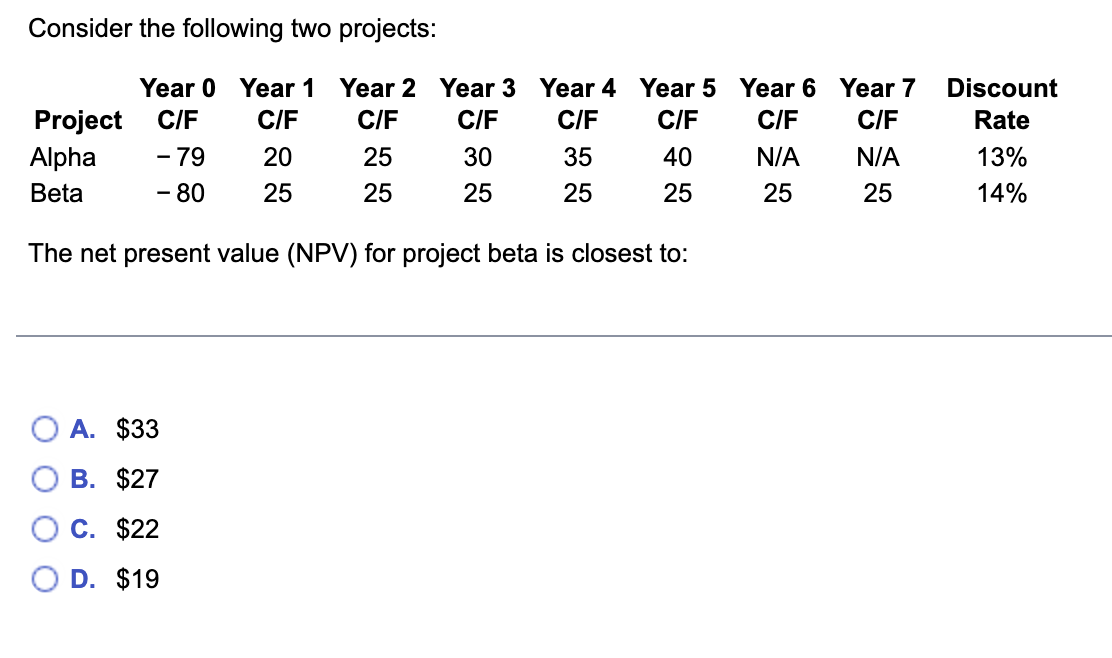

Question: Consider the following two projects: Project Alpha Beta Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 C/F

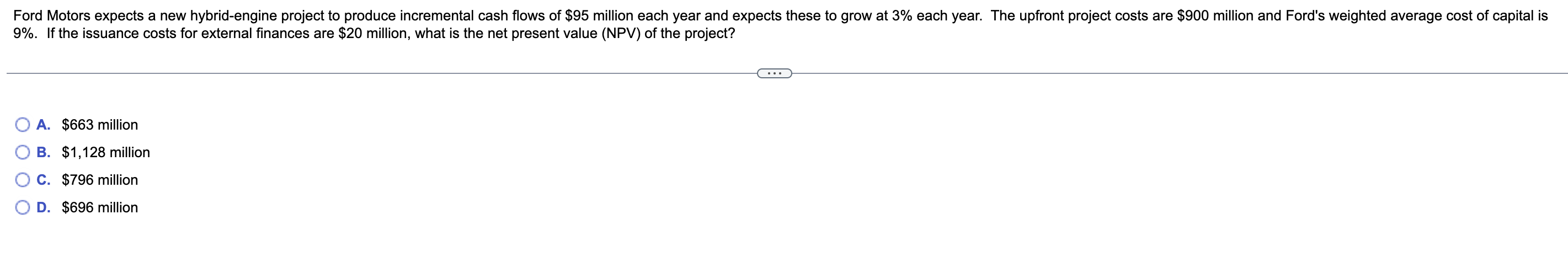

Consider the following two projects: Project Alpha Beta Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 C/F C/F C/F C/F C/F C/F C/F C/F - 79 20 25 30 35 40 NA N/A -80 25 25 25 25 25 25 25 Discount Rate 13% 14% The net present value (NPV) for project beta is closest to: A. $33 B. $27 C. $22 D. $19 Ford Motors expects a new hybrid-engine project to produce incremental cash flows of $95 million each year and expects these to grow at 3% each year. The upfront project costs are $900 million and Ford's weighted average cost of capital is 9%. If the issuance costs for external finances are $20 million, what is the net present value (NPV) of the project? O A. $663 million B. $1,128 million C. $796 million D. $696 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts