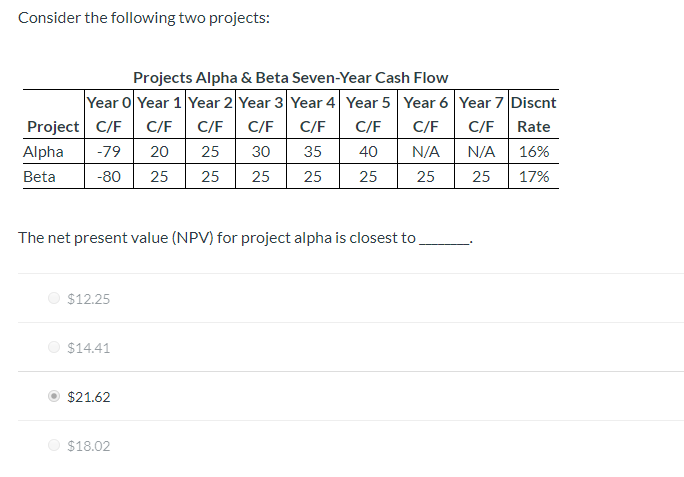

Question: Consider the following two projects: Projects Alpha & Beta Seven-Year Cash Flow Year Ol Year 1 Year 2 Year 3 Year 4 Year 5 Year

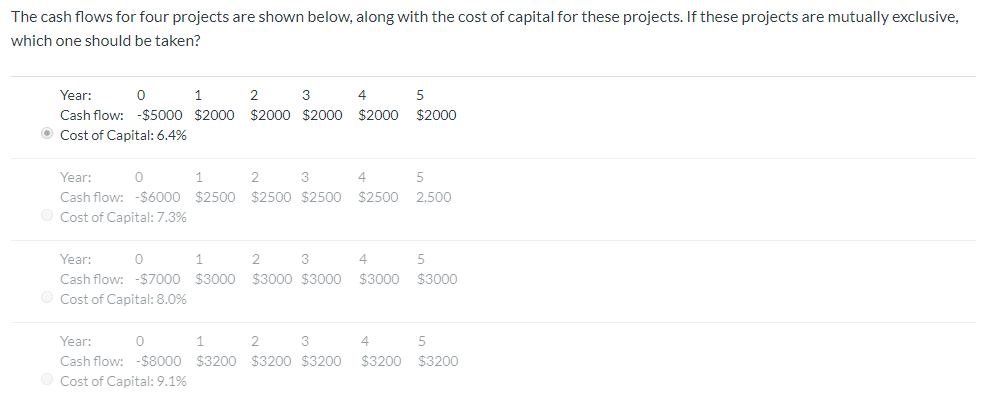

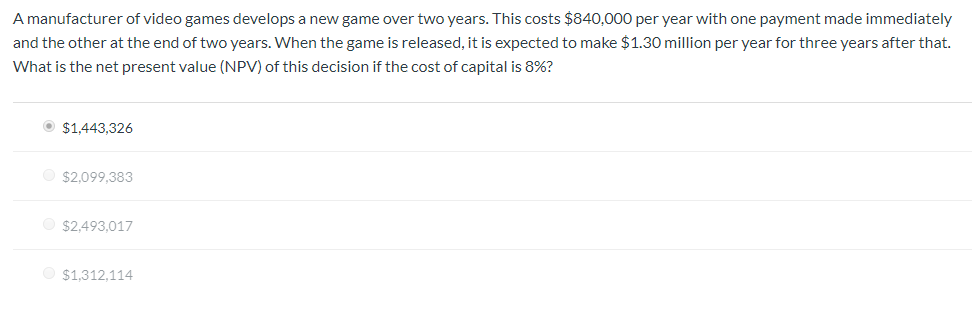

Consider the following two projects: Projects Alpha & Beta Seven-Year Cash Flow Year Ol Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Discnt Project C/ FC/ FC/ FC/ FC/ FC/ FC/ FC/F Rate Alpha -79 20 25 30 35 40 N/A N/A 16% Beta -80 25 25 25 25 25 25 25 17% The net present value (NPV) for project alpha is closest to ____ $12.25 $14.41 $21.62 $18.02 The cash flows for four projects are shown below, along with the cost of capital for these projects. If these projects are mutually exclusive, which one should be taken? Year: 0 1 Cash flow: -$5000 $2000 Cost of Capital: 6.4% 2 3 $2000 $2000 4 5 $2000 $2000 Year: o Cash flow: -$6000 Cost of Capital: 7.3% 1 2 3 $2500 $2500 $2500 4 $2500 5 2,500 Year: o 1 2 3 Cash flow: -$7000 $3000 $3000 $3000 Cost of Capital: 8.0% 4 5 $3000 $3000 Year: 0 1 2 3 Cash flow: $8000 $3200 $3200 $3200 Cost of Capital: 9.1% 4 5 $3200 $3200 A manufacturer of video games develops a new game over two years. This costs $840,000 per year with one payment made immediately and the other at the end of two years. When the game is released, it is expected to make $1.30 million per year for three years after that. What is the net present value (NPV) of this decision if the cost of capital is 8%? $1,443,326 $2,099,383 $2,493,017 $1,312,114

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts