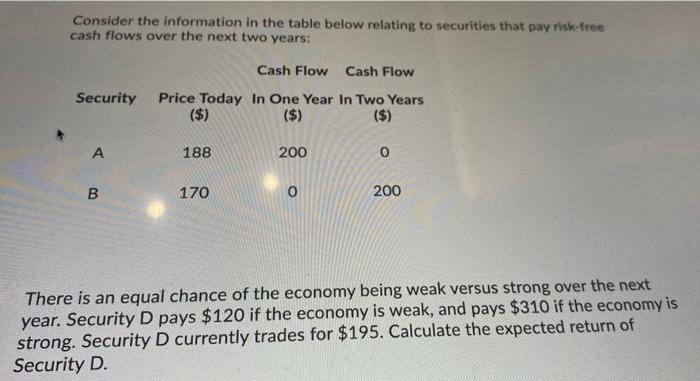

Question: Consider the information in the table below relating to securities that pay risk-free cash flows over the next two years: Cash Flow Cash Flow Security

Consider the information in the table below relating to securities that pay risk-free cash flows over the next two years: Cash Flow Cash Flow Security Price Today In One Year In Two Years ($) ($) ($) A 188 200 0 00 170 0 200 There is an equal chance of the economy being weak versus strong over the next year. Security D pays $120 if the economy is weak, and pays $310 if the economy is strong. Security D currently trades for $195. Calculate the expected return of Security D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts