Question: What is the answer to question C? Could you show your work too? thanks. Consider two securities that pay risk-free cash flows over the next

What is the answer to question C? Could you show your work too? thanks.

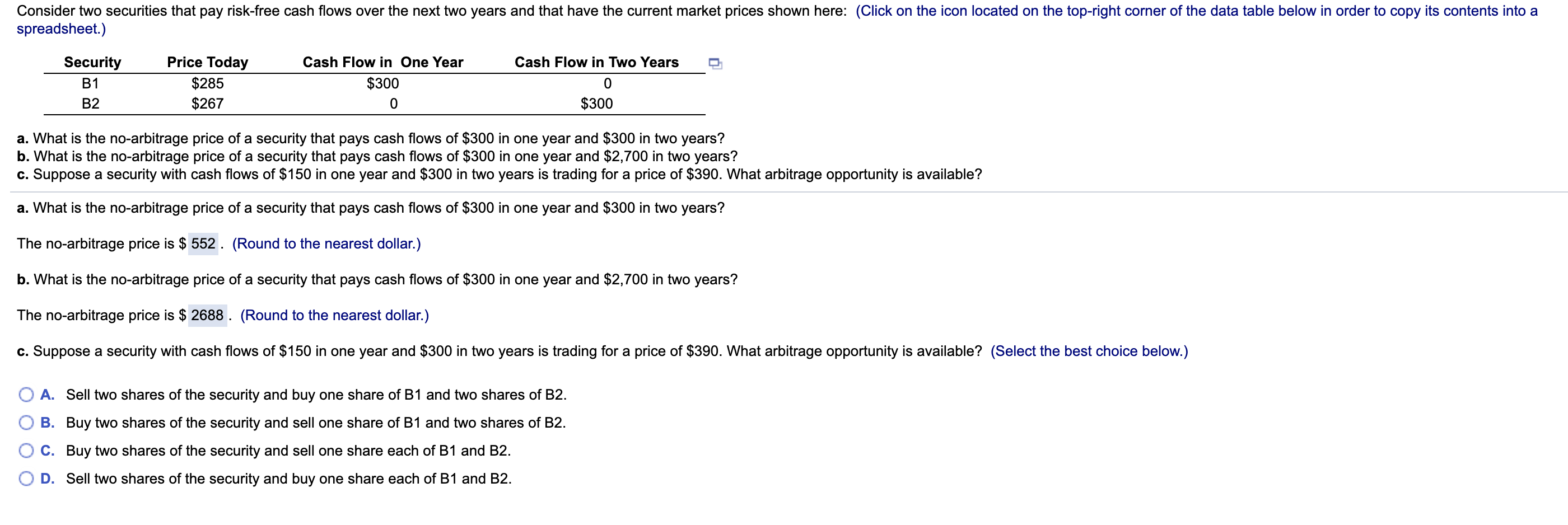

Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Cash Flow in Two Years Security B1 B2 Price Today $285 $267 Cash Flow in One Year $300 0 0 $300 a. What is the no-arbitrage price of a security that pays cash flows of $300 in one year and $300 in two years? b. What is the no-arbitrage price of a security that pays cash flows of $300 in one year and $2,700 in two years? c. Suppose a security with cash flows of $150 in one year and $300 in two years is trading for a price of $390. What arbitrage opportunity is available? a. What is the no-arbitrage price of a security that pays cash flows of $300 in one year and $300 in two years? The no-arbitrage price is $ 552 . (Round to the nearest dollar.) b. What is the no-arbitrage price of a security that pays cash flows of $300 in one year and $2,700 in two years? The no-arbitrage price is $ 2688 . (Round to the nearest dollar.) c. Suppose a security with cash flows of $150 in one year and $300 in two years is trading for a price of $390. What arbitrage opportunity is available? (Select the best choice below.) O A. Sell two shares of the security and buy one share of B1 and two shares of B2. O B. Buy two shares of the security and sell one share of B1 and two shares of B2. O C. Buy two shares of the security and sell one share each of B1 and B2. OD. Sell two shares of the security and buy one share each of B1 and B2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts