Question: Consider the optimization problem of maximizing the Sharpe Ratio, given a riskless asset with the return r>0 and n = 5 possible risky assets whose

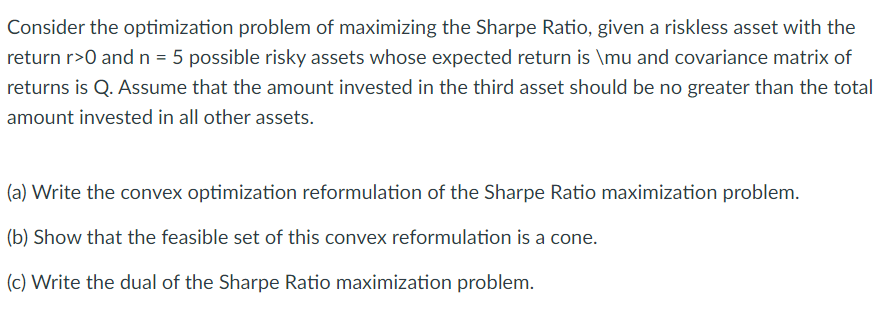

Consider the optimization problem of maximizing the Sharpe Ratio, given a riskless asset with the return r>0 and n = 5 possible risky assets whose expected return is \mu and covariance matrix of returns is Q. Assume that the amount invested in the third asset should be no greater than the total amount invested in all other assets. (a) Write the convex optimization reformulation of the Sharpe Ratio maximization problem. (b) Show that the feasible set of this convex reformulation is a cone. (c) Write the dual of the Sharpe Ratio maximization problem. Consider the optimization problem of maximizing the Sharpe Ratio, given a riskless asset with the return r>0 and n = 5 possible risky assets whose expected return is \mu and covariance matrix of returns is Q. Assume that the amount invested in the third asset should be no greater than the total amount invested in all other assets. (a) Write the convex optimization reformulation of the Sharpe Ratio maximization problem. (b) Show that the feasible set of this convex reformulation is a cone. (c) Write the dual of the Sharpe Ratio maximization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts