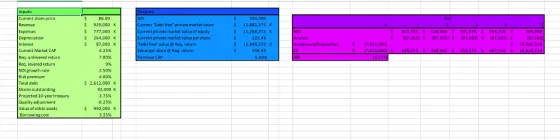

Question: Consider the REIT valuation spreadsheet presented in class. For each of the following scenarios, and all other things equal, determine whether each scenario will increase,

Consider the REIT valuation spreadsheet presented in class. For each of the following scenarios, and all other things equal, determine whether each scenario will increase, decrease or won? Affect the probability that new investors will achieve their levered required rate of return.

a. The price of the REIT is lower.

b. A distribution is defined for NOI growth rate, where the average value remains the same, but the right ?tail? of the distribution is longer than the left ?tail?.

c. The projected 10-year treasury rate is higher.

d. The quality adjustment value is lower.

e. The risk premium is lower.

f. The current market cap is higher.

g. The required levered return is higher.

MAP verdur Qty at $ $15.000 1777,000 264.000 F 1.800 -1.909 $2612000 $1,000 1358 25% $10,000x 3338 122.49 @m MELATE MAJOR TAMIL WEBSH

Step by Step Solution

There are 3 Steps involved in it

The following are the main financial ideas that are present in the scenarios about investor return probability and REIT Real Estate Investment Trust v... View full answer

Get step-by-step solutions from verified subject matter experts