Question: Consider the risk-neutral Ho-Lee model for continuously compounded rates with a step size of A = 1 year: T+1 = + + 0 +

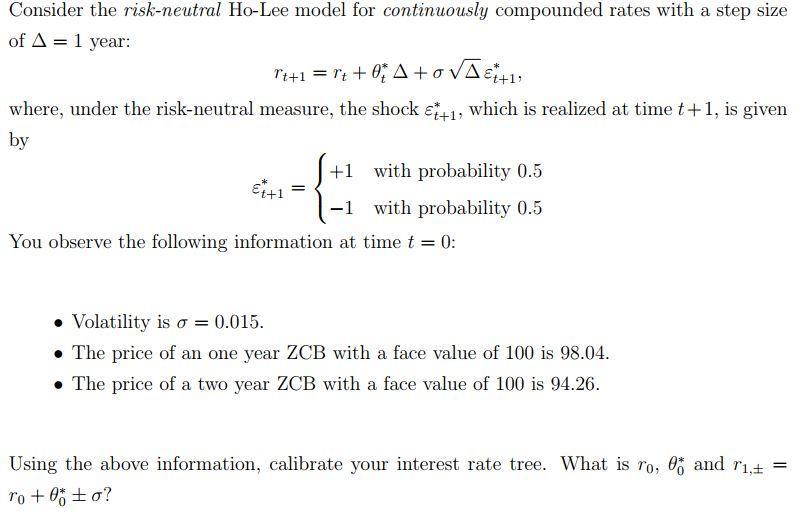

Consider the risk-neutral Ho-Lee model for continuously compounded rates with a step size of A = 1 year: T+1 = + + 0 + 0 +1 where, under the risk-neutral measure, the shock +1, which is realized at time t+1, is given by S+ 1+1 = +1 with probability 0.5 -1 with probability 0.5 You observe the following information at time t = 0: Volatility is = 0.015. The price of an one year ZCB with a face value of 100 is 98.04. The price of a two year ZCB with a face value of 100 is 94.26. Using the above information, calibrate your interest rate tree. What is ro, 0 and r, = ro +0 o?

Step by Step Solution

There are 3 Steps involved in it

To calibrate the interest rate tree we can use the prices of zerocoupon bonds ZCBs to solve for the ... View full answer

Get step-by-step solutions from verified subject matter experts