Question: Consider the sensitivity report below: Variables Solution Reduced Cost Original Value Lower Upper Bound Bound R 100 0 2.15 1.95 2.60 W 192 0 1.90

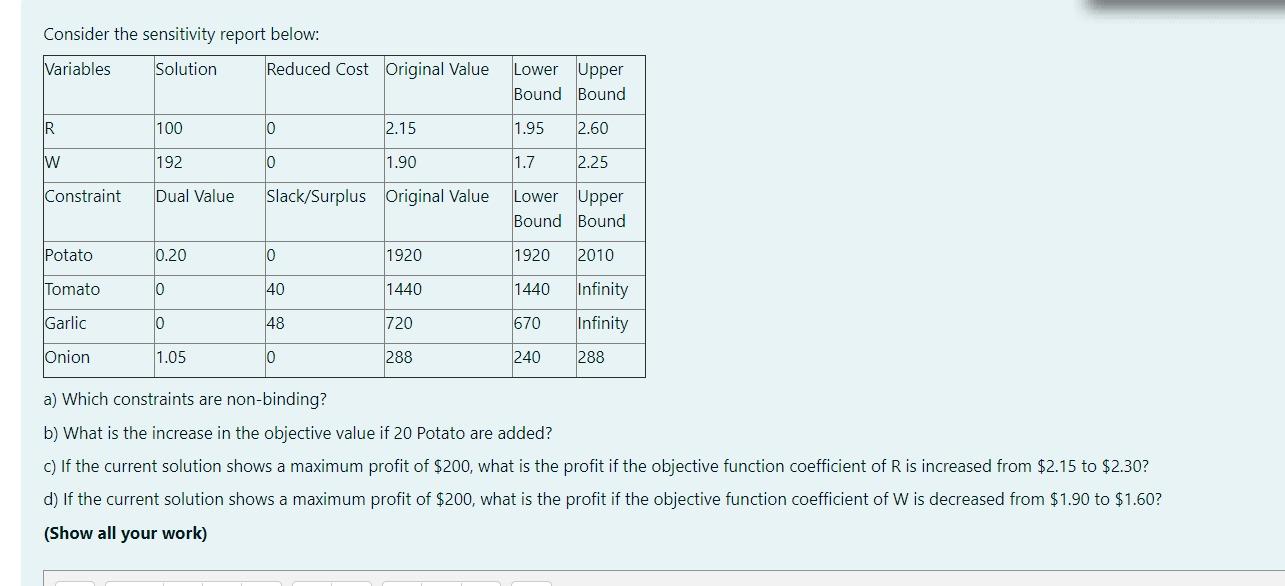

Consider the sensitivity report below: Variables Solution Reduced Cost Original Value Lower Upper Bound Bound R 100 0 2.15 1.95 2.60 W 192 0 1.90 1.7 2.25 Constraint Dual Value Slack/Surplus Original Value Lower Upper Bound Bound Potato 0.20 10 1920 1920 2010 Tomato 0 40 1440 1440 Infinity Garlic 10 48 720 670 Infinity Onion 1.05 10 288 240 288 a) Which constraints are non-binding? b) What is the increase in the objective value of 20 Potato are added? c) If the current solution shows a maximum profit of $200, what is the profit if the objective function coefficient of R is increased from $2.15 to $2.30? d) If the current solution shows a maximum profit of $200, what is the profit if the objective function coefficient of W is decreased from $1.90 to $1.60? (Show all your work)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts