Question

Consider the variance-covariance matrix of annual returns shown below for three stocks. The forecasted annual returns are .09, .06 and .05 for stocks 1, 2

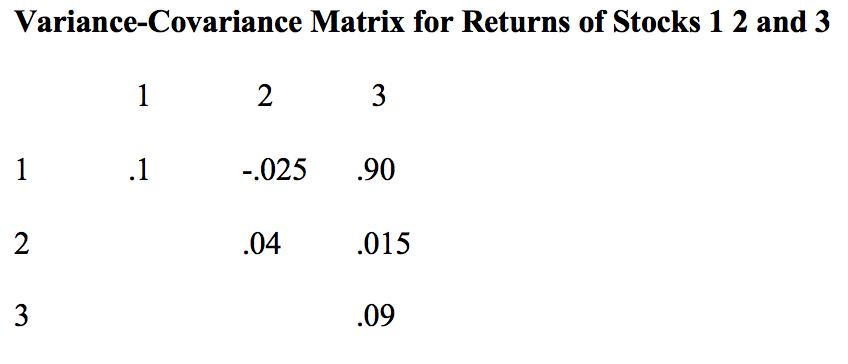

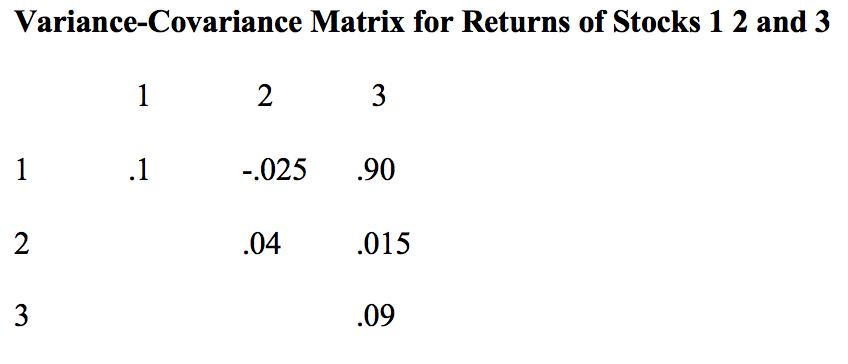

Consider the variance-covariance matrix of annual returns shown below for three stocks. The forecasted annual returns are .09, .06 and .05 for stocks 1, 2 and 3, respectively.

Develop an algebraic optimization model that will find a minimum variance portfolio with an expected return of at least .07, such that at most 80% of the portfolio is stock 2 and at least 10% of the portfolio is stock 3.

Consider the variance-covariance matrix of annual returns shown below for three stocks. The forecasted annual returns are .09, .06 and .05 for stocks 1, 2 and 3, respectively.

Develop an algebraic optimization model that will find a minimum variance portfolio with an expected return of at least .07, such that at most 80% of the portfolio is stock 2 and at least 10% of the portfolio is stock 3.

Variance-Covariance Matrix for Returns of Stocks 1 2 and 3 1 2 3 1 .1 -.025 .90 2 .04 .015 .09 3.

Step by Step Solution

3.35 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments Analysis and Management

Authors: Charles P. Jones

12th edition

978-1118475904, 1118475909, 1118363299, 978-1118363294

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App