Question: Consider three call options on the same underlying stock and same expiration date. You buy the call with X=40, buy the call with X=30, and

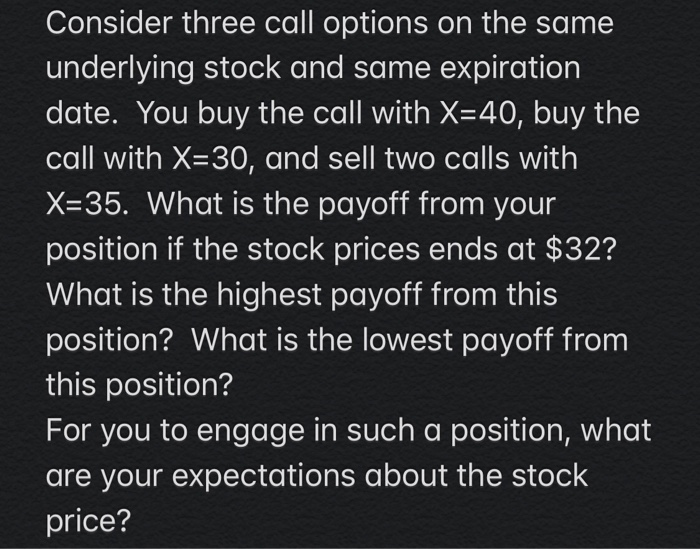

Consider three call options on the same underlying stock and same expiration date. You buy the call with X=40, buy the call with X=30, and sell two calls with X=35. What is the payoff from your position if the stock prices ends at $32? What is the highest payoff from this position? What is the lowest payoff from this position? For you to engage in such a position, what are your expectations about the stock price? PS: In all questions above X denotes the exercise price of the options, C=call premium, P=put premium, and S=stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts