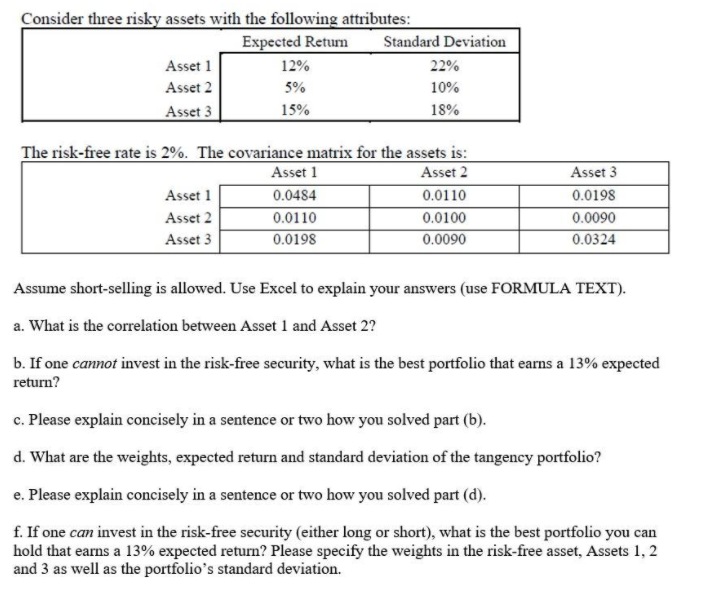

Question: Consider three risky assets with the following attributes: Expected Return Standard Deviation Asset 1 12% 22% Asset 2 10% Asset 3 15% 18% 5% The

Consider three risky assets with the following attributes: Expected Return Standard Deviation Asset 1 12% 22% Asset 2 10% Asset 3 15% 18% 5% The risk-free rate is 2%. The covariance matrix for the assets is: Asset 1 Asset 2 Asset 1 0.0484 0.0110 Asset 2 0.0110 0.0100 Asset 3 0.0198 0.0090 Asset 3 0.0198 0.0090 0.0324 Assume short-selling is allowed. Use Excel to explain your answers (use FORMULA TEXT). a. What is the correlation between Asset 1 and Asset 2? b. If one cannot invest in the risk-free security, what is the best portfolio that earns a 13% expected return? c. Please explain concisely in a sentence or two how you solved part (b). d. What are the weights, expected return and standard deviation of the tangency portfolio? e. Please explain concisely in a sentence or two how you solved part (d). f. If one can invest in the risk-free security (either long or short), what is the best portfolio you can hold that earns a 13% expected return? Please specify the weights in the risk-free asset, Assets 1, 2 and 3 as well as the portfolio's standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts