Question: Consider three securities that pay cash flows over the next year. Their cash flows in one year depend on the market condition which could be

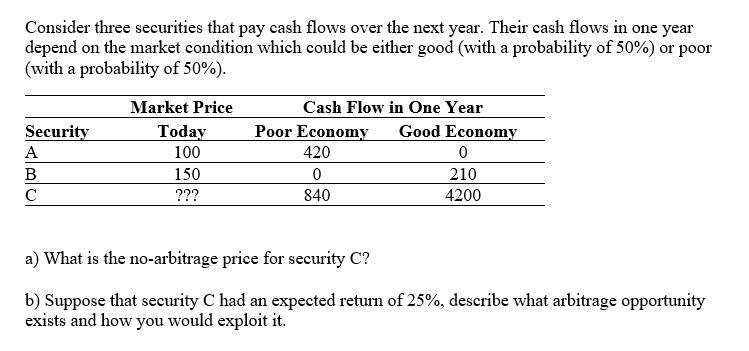

Consider three securities that pay cash flows over the next year. Their cash flows in one year depend on the market condition which could be either good (with a probability of 50%) or poor (with a probability of 50%). Security A B Market Price Today 100 150 ??? Cash Flow in One Year Poor Economy Good Economy 420 0 0 210 840 4200 a) What is the no-arbitrage price for security C? b) Suppose that security C had an expected return of 25%, describe what arbitrage opportunity exists and how you would exploit it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock