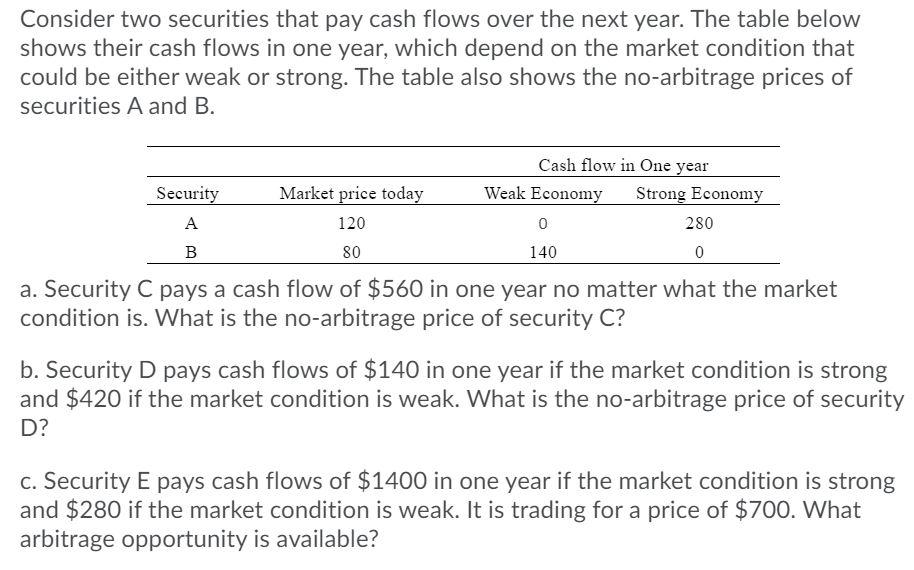

Question: Consider two securities that pay cash flows over the next year. The table below shows their cash flows in one year, which depend on the

Consider two securities that pay cash flows over the next year. The table below shows their cash flows in one year, which depend on the market condition that could be either weak or strong. The table also shows the no-arbitrage prices of securities A and B. Security Market price today 120 Cash flow in One year Weak Economy Strong Economy 0 280 A B 80 140 0 a. Security C pays a cash flow of $560 in one year no matter what the market condition is. What is the no-arbitrage price of security C? b. Security D pays cash flows of $140 in one year if the market condition is strong and $420 if the market condition is weak. What is the no-arbitrage price of security D? c. Security E pays cash flows of $1400 in one year if the market condition is strong and $280 if the market condition is weak. It is trading for a price of $700. What arbitrage opportunity is available? Consider two securities that pay cash flows over the next year. The table below shows their cash flows in one year, which depend on the market condition that could be either weak or strong. The table also shows the no-arbitrage prices of securities A and B. Security Market price today 120 Cash flow in One year Weak Economy Strong Economy 0 280 A B 80 140 0 a. Security C pays a cash flow of $560 in one year no matter what the market condition is. What is the no-arbitrage price of security C? b. Security D pays cash flows of $140 in one year if the market condition is strong and $420 if the market condition is weak. What is the no-arbitrage price of security D? c. Security E pays cash flows of $1400 in one year if the market condition is strong and $280 if the market condition is weak. It is trading for a price of $700. What arbitrage opportunity is available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts