Question: show work please Question 5 (20 points): Consider three securities that pay cash flows over the next year. Their cash flows in one year depend

show work please

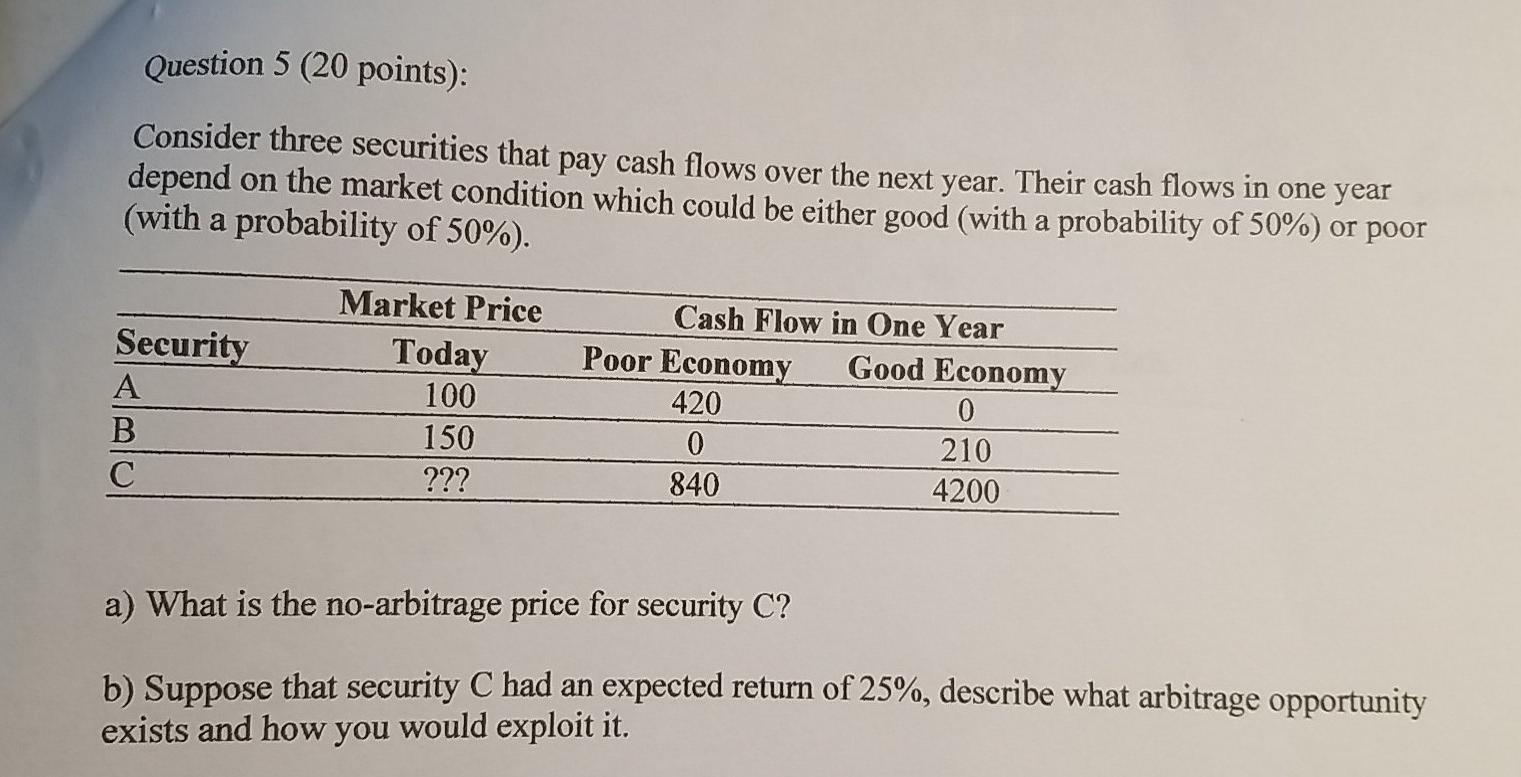

Question 5 (20 points): Consider three securities that pay cash flows over the next year. Their cash flows in one year depend on the market condition which could be either good (with a probability of 50%) or poor (with a probability of 50%). Security A B C Market Price Today 100 150 ??? Cash Flow in One Year Poor Economy Good Economy 420 0 0 210 840 4200 a) What is the no-arbitrage price for security C? b) Suppose that security C had an expected return of 25%, describe what arbitrage opportunity exists and how you would exploit it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock