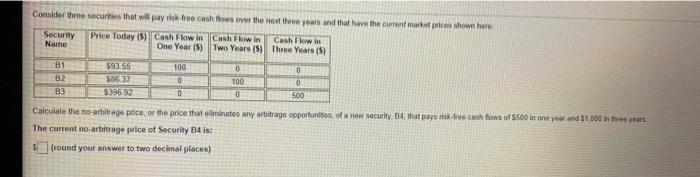

Question: Consider three securities that will pay free cash flows over the next three years and that have the current market price shown here Security Price

Consider three securities that will pay free cash flows over the next three years and that have the current market price shown here Security Price Today ($) Cash Flow in Cash flow in Cash Flow in Name One Year(s) Two Years (5) Three Years (5) 0 B1 82 B3 $93.55 58537 $396.92 100 0 0 100 0 0 500 0 Calculate the noarbitrage price or the price that minutes any arbitrage opportunities of new security, 14th paytiske cash flows of 5500 in one year and 51 000 ini ya The current no arbitrage price of Security B4 is (round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock