Question: Consider two assets with expected returns and risks given as the following: If the asset returns have a correlation coefficient of 0.5, what is the

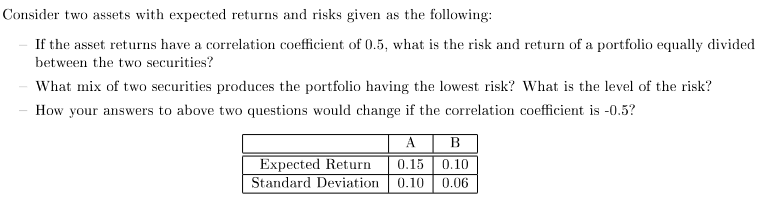

Consider two assets with expected returns and risks given as the following: If the asset returns have a correlation coefficient of 0.5, what is the risk and return of a portfolio equally divided between the two securities? What mix of two securities produces the portfolio having the lowest risk? What is the level of the risk? How your answers to above two questions would change if the correlation coefficient is 0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts