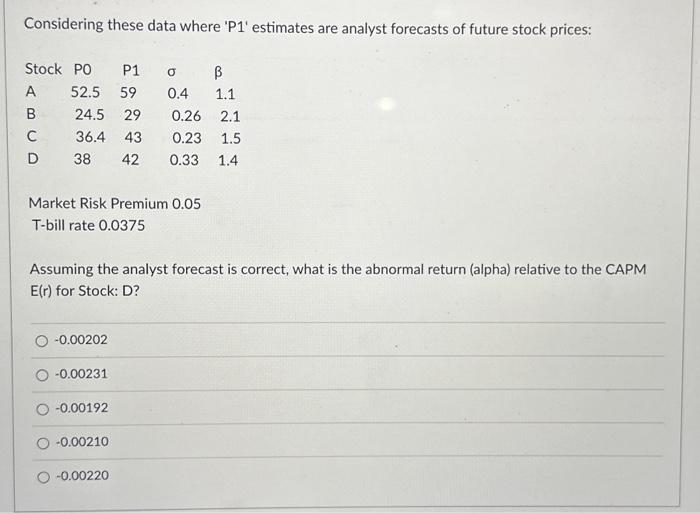

Question: Considering these data where ' P1 ' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.05 T-bill rate 0.0375 Assuming the analyst

Considering these data where ' P1 ' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.05 T-bill rate 0.0375 Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: D? 0.00202 0.00231 0.00192 0.00210 0.00220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts