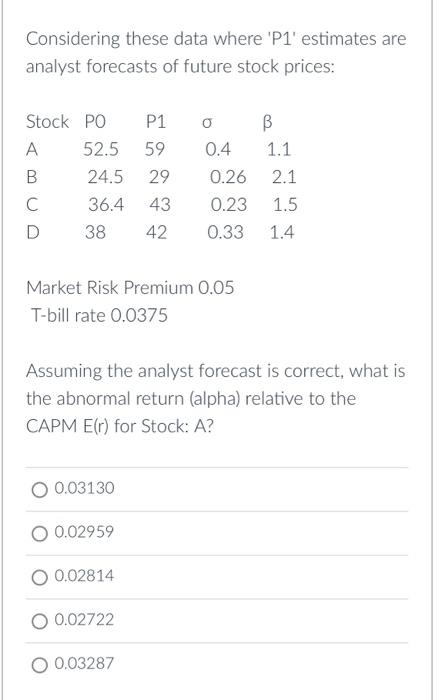

Question: Considering these data where ' P1 ' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.05 T-bill rate 0.0375 Assuming the analyst

Considering these data where ' P1 ' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.05 T-bill rate 0.0375 Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: A? \begin{tabular}{l} 0.03130 \\ \hline 0.02959 \\ \hline 0.02814 \\ \hline 0.02722 \\ \hline 0.03287 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts