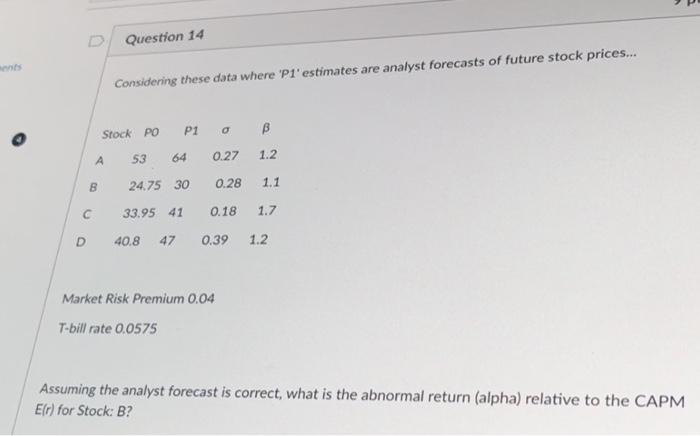

Question: HELP ASAP PLEASE Considering these data where 'P1' estimates are analyst forecasts of future stock prices... Market Risk Premium 0.04 T-bill rate 0.0575 Assuming the

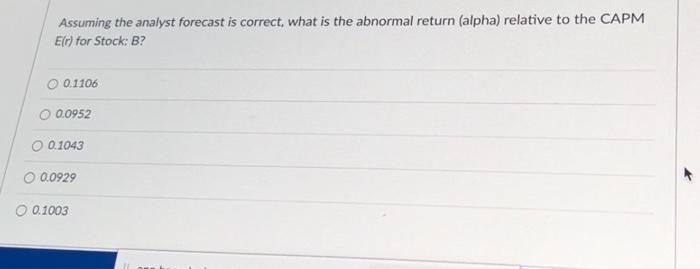

Considering these data where 'P1' estimates are analyst forecasts of future stock prices... Market Risk Premium 0.04 T-bill rate 0.0575 Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: B? Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: B? 0.1106 0.0952 0.1043 0.0929 0.1003

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts