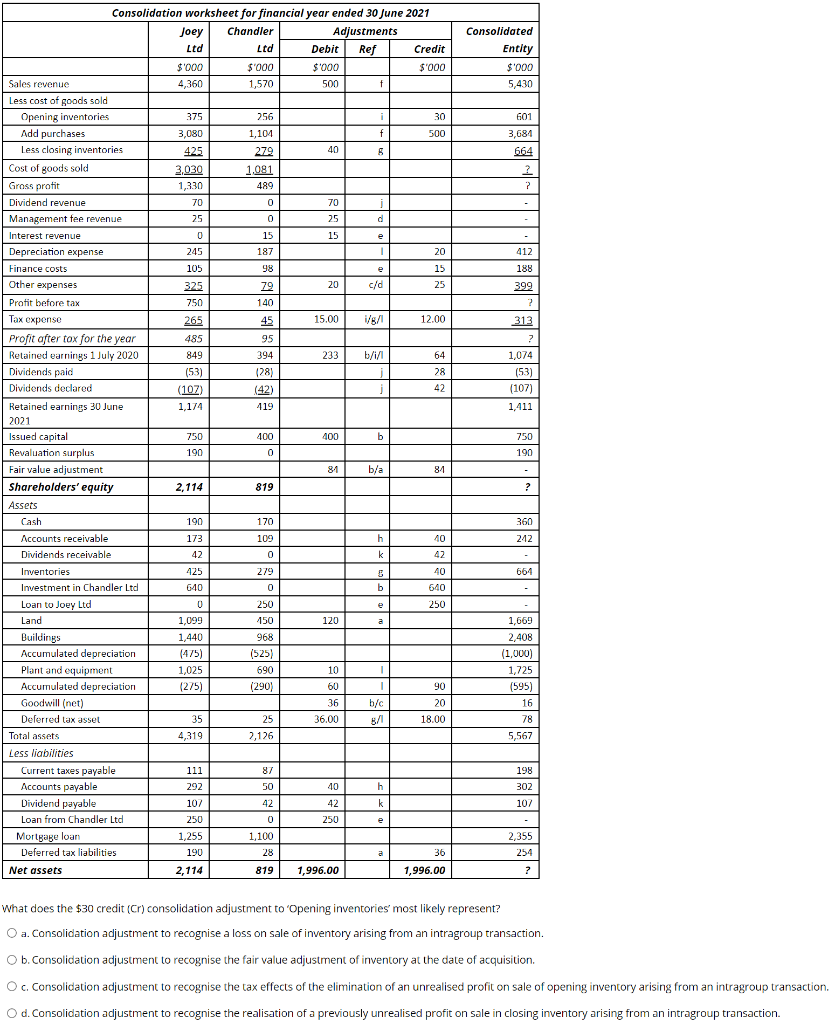

Question: Consolidated Entity $'000 5,430 601 3,684 664 ? ? e 412 188 399 ? 313 ? 1,074 (53) (107) 1,111 750 Consolidation worksheet for financial

Consolidated Entity $'000 5,430 601 3,684 664 ? ? e 412 188 399 ? 313 ? 1,074 (53) (107) 1,111 750 Consolidation worksheet for financial year ended 30 June 2021 Joey Chandler Adjustments Ltd Ltd Debit Ref Credit $'000 $'000 $'000 $'000 Sales revenue 4,360 1,570 500 f Less cost of goods sold Opening inventories 375 256 i 30 Add purchases 3,080 1,104 f 500 Less closing inventories 425 279 40 5 Cost of goods sold 3.030 1,081 Gross profit 1,330 489 Dividend revenue 70 0 70 i Management fee revenue 25 0 25 Interest revenue 0 15 15 Depreciation expense 245 187 1 20 Finance costs 105 98 e 15 Other expenses 325 79 20 c/d 25 Pratit before tax 750 140 Tax expense 265 45 15.00 1/6/1 12.00 Profit after tox for the year 485 95 Retained earnings 1 July 2020 849 394 233 b/i/ 64 Dividends paid (53) (28) 28 Dividends declared (107) (42) j 42 Retained earnings 30 June 1,174 419 2021 Issued capital 750 400 400 b Revaluation surplus 190 0 Fair value adjustment 81 b/a 81 Shareholders' equity 2,114 819 Assets Cash 190 170 Accounts receivable 173 109 h 40 Dividends receivable 42 0 k 42 Inventories 425 279 122 3 40 Investment in Chandler Ltd 640 0 b 640 Loan to Joey Ltd U 230 e 250 Land 1,099 150 120 a a Buildings 1,440 968 Accumulated depreciation (475) (525) Plant and equipment 1,025 690 10 1 Accumulated depreciation (275) (290) 60 1 90 Goodwill (net) 36 b/c 20 Deferred lax asset 35 25 36.00 8/1 18.00 Total assets 4,319 2,126 Less liabilities Current taxes payable 111 87 Accounts payable 292 50 40 h Dividend payable 107 42 42 k Loan from Chandler Ltd 250 0 250 e Mortgage loan 1,255 1,100 Deferred tax liabilities 190 28 36 Net assets 2,114 819 1,996.00 1,996.00 190 ? 360 242 664 250 1,669 2,408 (1,000) 1,725 (595) 16 78 5,567 198 302 107 2,355 254 ? What does the $30 credit (Cr) consolidation adjustment to 'Opening inventories' most likely represent? O a. Consolidation adjustment to recognise a loss on sale of inventory arising from an intragroup transaction. Ob. Consolidation adjustment to recognise the fair value adjustment of inventory at the date of acquisition. Oc Consolidation adjustment to recognise the tax effects of the elimination of an unrealised profit on sale of opening inventory arising from an intragroup transaction. Od. Consolidation adjustment to recognise the realisation of a previously unrealised profit on sale in closing inventory arising from an intragroup transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts