Question: Constructing and Assessing Income Statements Using Cost - to - Cost Method Gilbert Construction contracted to build a shopping center at a contract price of

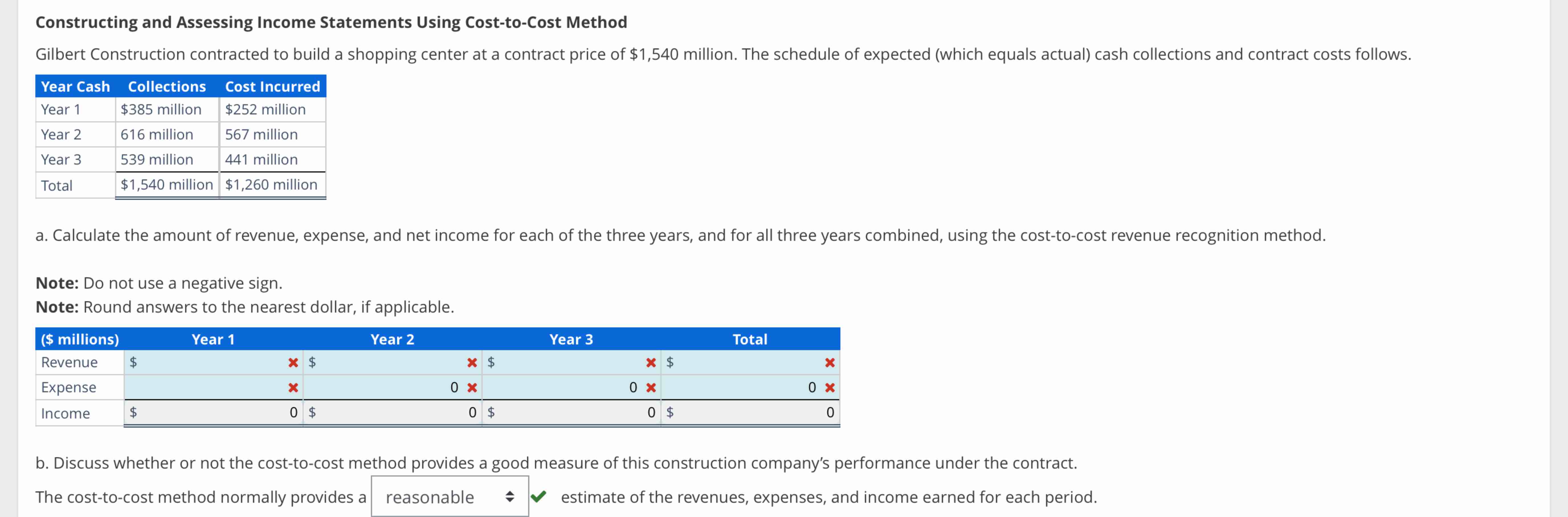

Constructing and Assessing Income Statements Using CosttoCost Method

Gilbert Construction contracted to build a shopping center at a contract price of $ million. The schedule of expected which equals actual cash collections and contract costs follows.

a Calculate the amount of revenue, expense, and net income for each of the three years, and for all three years combined, using the costtocost revenue recognition method.

Note: Do not use a negative sign.

Note: Round answers to the nearest dollar, if applicable.

b Discuss whether or not the costtocost method provides a good measure of this construction company's performance under the contract.

The costtocost method normally provides a reasonable estimate of the revenues, expenses, and income earned for each period.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock