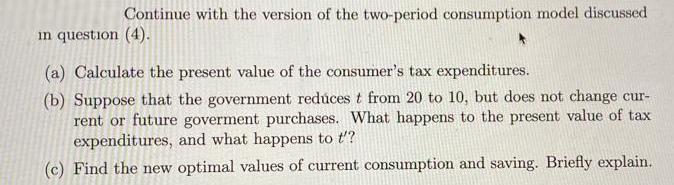

Question: Continue with the version of the two-period consumption model discussed in question (4). (a) Calculate the present value of the consumer's tax expenditures. (b)

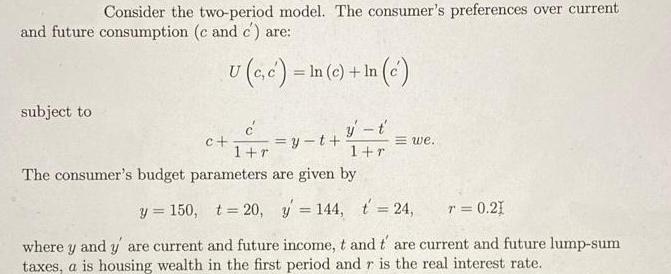

Continue with the version of the two-period consumption model discussed in question (4). (a) Calculate the present value of the consumer's tax expenditures. (b) Suppose that the government redcest from 20 to 10, but does not change cur- rent or future goverment purchases. What happens to the present value of tax expenditures, and what happens to t'? (c) Find the ew optimal values of current consumption and saving. Briefly explain. Consider the two-period model. The consumer's preferences over current and future consumption (c and c) are: U (c,c) = In (e) + In () subject to y-t c+ 1+r = y -t+ = we. 1+r The consumer's budget parameters are given by y = 150, t = 20, y = 144, t = 24, r = 0.21 %3D where y and y are current and future income, t and t are current and future lump-sum taxes, a is housing wealth in the first period and r is the real interest rate.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

ct fyt ynt Qiven the two period model uec Lnlc ence ... View full answer

Get step-by-step solutions from verified subject matter experts