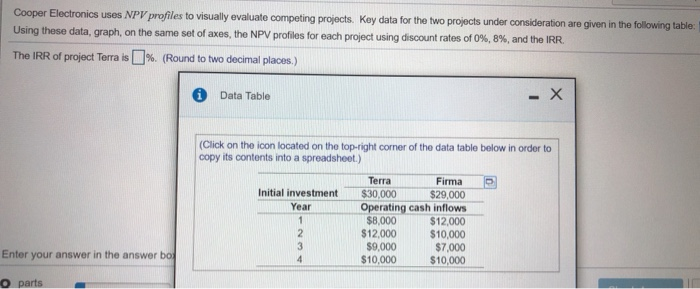

Question: Cooper Electronics uses NPV profiles to visually evaluate competing projects. Key data for the two projects under consideration are given in the following table Using

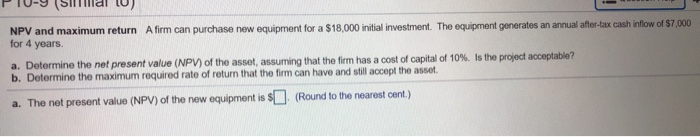

Cooper Electronics uses NPV profiles to visually evaluate competing projects. Key data for the two projects under consideration are given in the following table Using these data, graph, on the same set of axes, the NPV profiles for each project using discount rates of 0%, 8%, and the IRR. The IRR of project Terra is %. (Round to two decimal places.) Data Table - X (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Initial investment Year Terra Firma $30,000 $29,000 Operating cash inflows $8.000 $12,000 $12.000 $10,000 $9,000 $7,000 $10,000 $10,000 Enter your answer in the answer bog TOUHO NPV and maximum return Afirm can purchase new equipment for a $18,000 initial investment. The equipment generates an annual after-tax cash inflow of $7.000 for 4 years. a. Determine the nel present value (NPV) of the asset, assuming that the firm has a cost of capital of 10%. Is the project acceptable? b. Determine the maximum required rate of return that the firm can have and still accept the asso a. The net present value (NPV) of the new equipment is $ . (Round to the nearest cont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts