Question: corperation actions 1 Unit 4 Individual Assignment - Will be graded Use the information provided in the attached pdf 'CURRO Rights Offer Circular'. Complete the

corperation actions 1

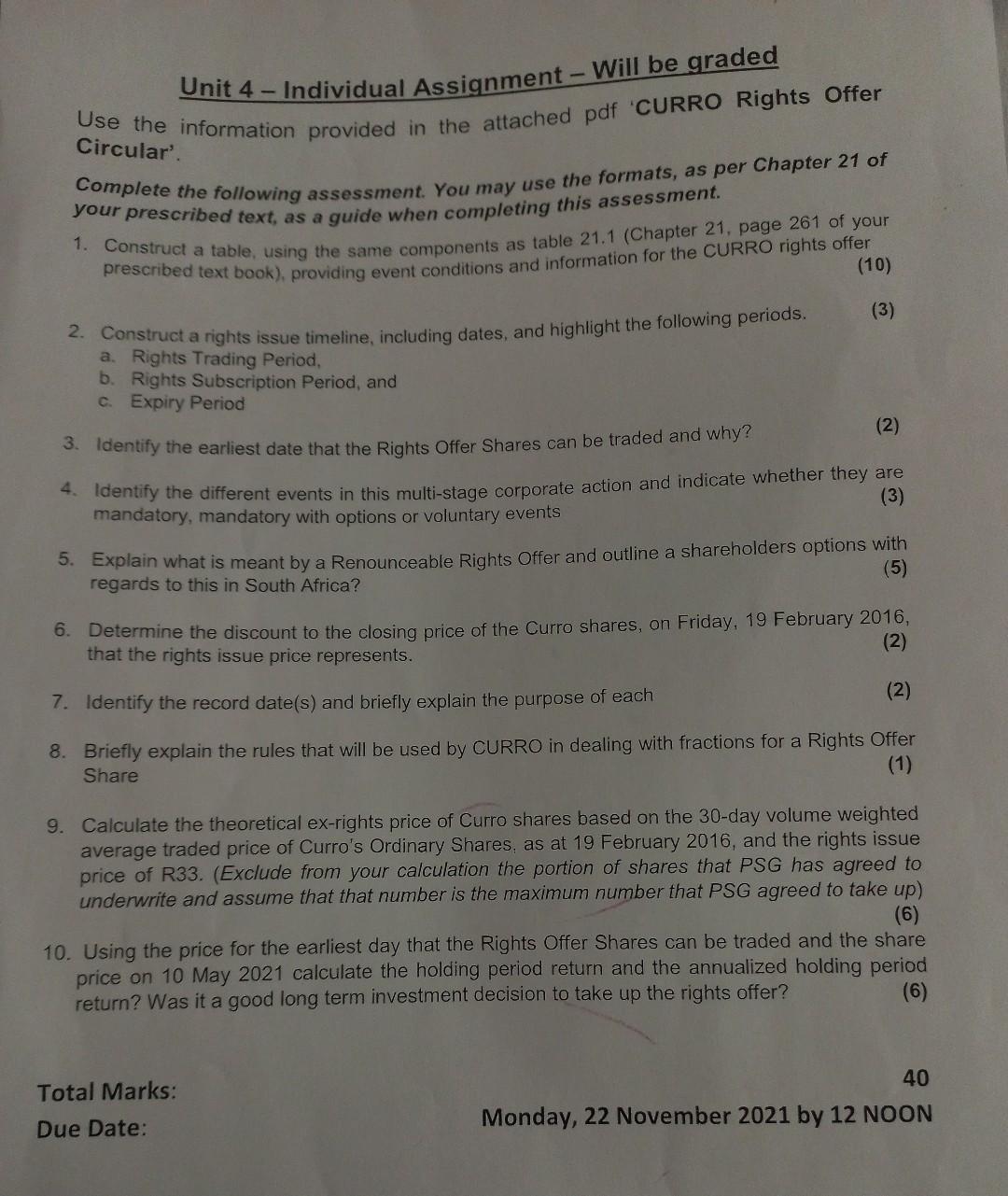

Unit 4 Individual Assignment - Will be graded Use the information provided in the attached pdf 'CURRO Rights Offer Circular'. Complete the following assessment. You may use the formats, as per Chapter 21 of your prescribed text, as a guide when completing this assessment 1. Construct a table, using the same components as table 21.1 (Chapter 21, page 261 of your (10) (3) 2. Construct a rights issue timeline, including dates, and highlight the following periods. a. Rights Trading Period, b. Rights Subscription Period, and c. Expiry Period (2) 3. Identify the earliest date that the Rights Offer Shares can be traded and why? 4. Identify the different events in this multi-stage corporate action and indicate whether they are (3) mandatory, mandatory with options or voluntary events 5. Explain what is meant by a Renounceable Rights Offer and outline a shareholders options with regards to this in South Africa? (5) 6. Determine the discount to the closing price of the Curro shares, on Friday, 19 February 2016, that the rights issue price represents. (2) 7. Identify the record date(s) and briefly explain the purpose of each (2) 8. Briefly explain the rules that will be used by CURRO in dealing with fractions for a Rights Offer Share (1) 9. Calculate the theoretical ex-rights price of Curro shares based on the 30-day volume weighted average traded price of Curro's Ordinary Shares, as at 19 February 2016, and the rights issue price of R33. (Exclude from your calculation the portion of shares that PSG has agreed to underwrite and assume that that number is the maximum number that PSG agreed to take up) (6) 10. Using the price for the earliest day that the Rights Offer Shares can be traded and the share price on 10 May 2021 calculate the holding period return and the annualized holding period return? Was it a good long term investment decision to take up the rights offer? (6) Total Marks: Due Date: 40 Monday, 22 November 2021 by 12 NOON Unit 4 Individual Assignment - Will be graded Use the information provided in the attached pdf 'CURRO Rights Offer Circular'. Complete the following assessment. You may use the formats, as per Chapter 21 of your prescribed text, as a guide when completing this assessment 1. Construct a table, using the same components as table 21.1 (Chapter 21, page 261 of your (10) (3) 2. Construct a rights issue timeline, including dates, and highlight the following periods. a. Rights Trading Period, b. Rights Subscription Period, and c. Expiry Period (2) 3. Identify the earliest date that the Rights Offer Shares can be traded and why? 4. Identify the different events in this multi-stage corporate action and indicate whether they are (3) mandatory, mandatory with options or voluntary events 5. Explain what is meant by a Renounceable Rights Offer and outline a shareholders options with regards to this in South Africa? (5) 6. Determine the discount to the closing price of the Curro shares, on Friday, 19 February 2016, that the rights issue price represents. (2) 7. Identify the record date(s) and briefly explain the purpose of each (2) 8. Briefly explain the rules that will be used by CURRO in dealing with fractions for a Rights Offer Share (1) 9. Calculate the theoretical ex-rights price of Curro shares based on the 30-day volume weighted average traded price of Curro's Ordinary Shares, as at 19 February 2016, and the rights issue price of R33. (Exclude from your calculation the portion of shares that PSG has agreed to underwrite and assume that that number is the maximum number that PSG agreed to take up) (6) 10. Using the price for the earliest day that the Rights Offer Shares can be traded and the share price on 10 May 2021 calculate the holding period return and the annualized holding period return? Was it a good long term investment decision to take up the rights offer? (6) Total Marks: Due Date: 40 Monday, 22 November 2021 by 12 NOON

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts