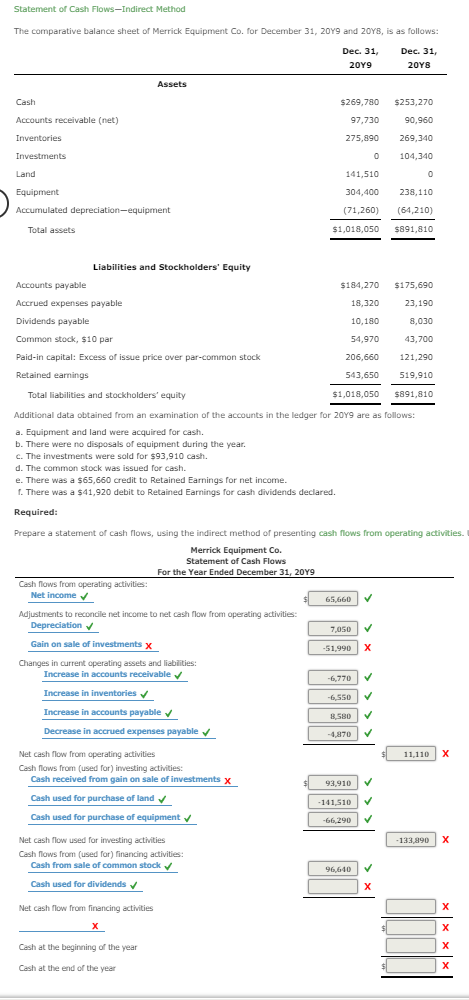

Question: Could someone help explain how to find the correct answers for the ones I got wrong. For where I put 11,110 and -133,890 I think

Could someone help explain how to find the correct answers for the ones I got wrong. For where I put 11,110 and -133,890 I think I just added wrong.

Statement of Cash Flows-Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31, 2019 and 2048, is as follows: Dec. 31, 2079 Dec. 31, 2088 Assets Cash Accounts receivable (net) Inventories Investments $269,780 $253,270 97,730 90,960 275,890 269,340 0 104,340 141,510 304,400238,110 (71,260) (64,210) $1,018,050 $891,810 Land Equipment Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity Accounts payable $184,270 $175,690 Accrued expenses payable 18,320 23,190 Dividends payable 10,180 8,030 Common stock, $10 par 54,970 43,700 Paid-in capital: Excess of issue price over par-common stock 206,660 121,290 Retained earnings 543,650 519,910 Total liabilities and stockholders' equity $1,018,050 $891,810 Additional data obtained from an examination of the accounts in the ledger for 2019 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $93,910 cash. d. The common stock was issued for cash. e. There was a $65,660 credit to Retained Earnings for net income. 1. There was a $41,920 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Merrick Equipment Co. Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from operating activities: Net Income $ 65.660 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation 7050 Gain on sale of investments x Changes in current operating assets and bites Increase in accounts receivable Increase in inventories Increase in accounts payable Decrease in accrued expenses payable s 11.110 Net cash flow from operating activities Cash flows from (used for) investing activities: Cash received from gain on sale of investments x Cash used for purchase of land Cash used for purchase of equipment Net cash flow used for investing activities Cash flows from used for) financing activities: Cash from sale of common stock Cash used for dividends Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts