Question: could somework solve this and show work also draw a timeline QUESTION 18 (Quantitative Question) Yonan Corporation's stock had a required return of 11.5 last

could somework solve this and show work also draw a timeline

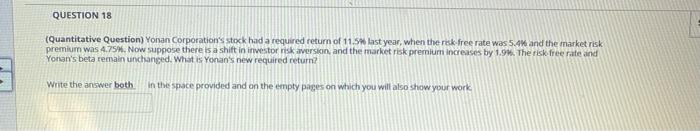

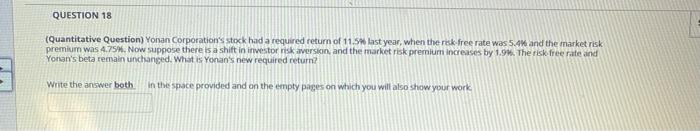

QUESTION 18 (Quantitative Question) Yonan Corporation's stock had a required return of 11.5 last year, when the risk free rate was 5.4 and the market risk premium was 4.75M. Now suppose there is a shift in investor risk aversion, and the market risk premium increases by 1.9. The risk free rate and Yonan's beta remain unchanged. What is Yonan's new required return Write the answer both in the space provided and on the empty pages on which you will also show your work

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock